Companion Animal Osteoarthritis Market by Product, Animal & Regional Analysis 2025-2033

The companion animal osteoarthritis market is set for substantial expansion as rising disease prevalence, advanced biologics, and improved diagnostic capabilities reshape veterinary care.

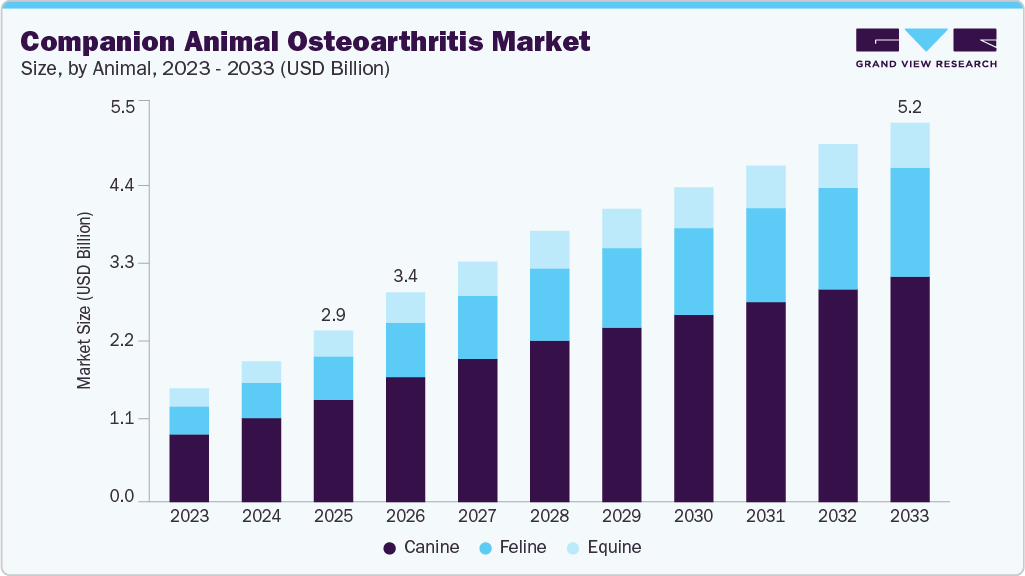

The global companion animal osteoarthritis market was valued at USD 2.29 billion in 2024 and is projected to reach USD 13.27 billion by 2033, expanding at a CAGR of 23.5% from 2025 to 2033. Market growth is driven by several factors, including the rising prevalence of osteoarthritis among companion animals, increasing R&D efforts, the emergence of novel therapies, greater awareness initiatives, and advancements in diagnostic technologies that support earlier detection and more effective OA management.

Osteoarthritis is becoming increasingly common in dogs, cats, and horses. In canines, an estimated 20% of dogs over one year of age show clinical signs of OA, with prevalence rising to as high as 80% in senior dogs, supported by both clinical and radiographic assessments. Among cats, OA has historically been underdiagnosed; however, recent studies suggest that up to 90% of cats older than 12 years show radiographic evidence of the condition. Equine OA also remains a significant contributor to reduced athletic performance and early retirement in sport and racehorses.

Multiple factors are fueling this rising prevalence, including longer pet lifespans due to improvements in veterinary care, higher rates of obesity—a key OA risk factor—and enhanced diagnostic capabilities that enable veterinarians to identify OA earlier and more accurately. As a result, demand is increasing for early diagnosis, long-term disease management, biologic therapies, and effective pain control solutions.

Key Market Trends & Insights

- North America held 42.3% of global market revenue in 2024.

- Asia Pacific is projected to grow at the fastest CAGR through 2033.

- By animal type, canines represented 47.9% of the market in 2024.

- By product, biologics accounted for approximately 53% of global revenue in 2024.

- By route of administration, injectables—including intramuscular and intra-articular options—are expected to grow the fastest over the forecast period.

Download a free sample PDF of the Companion Animal Osteoarthritis Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 2.29 Billion

- 2033 Forecast: USD 13.27 Billion

- CAGR (2025–2033): 23.5%

- Largest Regional Market: North America

- Fastest-Growing Region: Asia Pacific

Competitive Landscape

The companion animal osteoarthritis (CA OA) market is rapidly evolving, with advancements in therapeutic options influencing not only veterinary care but also the pet insurance industry. Innovative pain management solutions—such as monoclonal antibodies, radioisotope injections, and regenerative therapies—are increasing treatment costs, prompting more pet owners to seek insurance coverage for chronic, long-term conditions.

As new therapies enter the market and regulatory oversight strengthens, insurers are adapting policies to cover advanced treatments, including stem cell therapy and CBD-based products. Additionally, rising pet ownership, regional expansion of veterinary services, and growing demand for holistic and wellness-focused care are shaping the types of coverage that pet insurers must provide. This shift is transforming pet insurance from a discretionary expense into a practical necessity, particularly for aging animals at higher risk of OA.

Prominent Companies

- Zoetis Inc.

- Boehringer Ingelheim

- Elanco Animal Health

- American Regent, Inc.

- Merck Animal Health (Merck & Co. Inc.)

- Vetoquinol S.A.

- Ceva Sante Animale

- Virbac

- Biogenesis Bago

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The companion animal osteoarthritis market is set for substantial expansion as rising disease prevalence, advanced biologics, and improved diagnostic capabilities reshape veterinary care. With growing awareness among pet owners and increasing investment in innovative therapies, the market will continue to evolve rapidly through 2033. As treatment complexity and costs rise, pet insurance adoption is expected to increase in parallel, reinforcing the importance of comprehensive, long-term OA management for aging companion animals.