China Pet Food Market Demand for Specialized Health Diets Rising

The China pet food market is expanding rapidly, fueled by rising pet ownership, increasing health awareness, and a shift toward premiumization.

The China pet food market size was valued at USD 6.64 billion in 2024 and is projected to reach USD 10.10 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. Rising loneliness, declining birth rates, and a growing desire for companionship have fueled demand for pets in China. Millennials often view pets as a way to practice or substitute parenthood, while older generations embrace them for comfort and companionship, creating demand across multiple age groups.

A strong focus on pet health and wellness is a major driver of the Chinese pet food market. Consumers are increasingly aware of the link between nutrition and long-term well-being, leading to higher demand for organic, grain-free, raw, and functional pet food products. Formulas designed to address specific health concerns—such as allergies, digestion, joint support, and skin or coat care—are gaining popularity. In response, manufacturers in China are launching scientifically formulated, nutritionally advanced products to meet these evolving needs.

The surge in pet ownership, accelerated during the COVID-19 pandemic, has significantly widened China’s pet consumer base. Many households adopted pets during lockdowns, and this trend has continued post-pandemic. Consequently, the market is witnessing not only rising pet food consumption but also a shift toward premium, clean-label offerings tailored to pets’ breed, age, and lifestyle. This reflects a deeper emotional investment in pet care and a willingness among Chinese consumers to prioritize quality nutrition.

Domestic brands are heavily investing in R&D, incorporating traditional Chinese ingredients such as goji berries and herbs into pet food formulations. Clean-label practices and transparency in ingredient sourcing are also gaining traction. Meanwhile, e-commerce platforms like JD.com and Tmall have expanded access to premium and imported pet foods, while local companies are strengthening brand presence through digital marketing, pet influencer partnerships, and AI-driven nutrition recommendations.

Key Market Insights:

- By product: Dry pet food held a 59.8% revenue share in 2024, driven by convenience, longer shelf life, and affordability compared to wet or fresh options.

- By pet type: Dog food accounted for a 59.5% revenue share in 2024, supported by the rising popularity of dogs and the growing trend of treating them as family members.

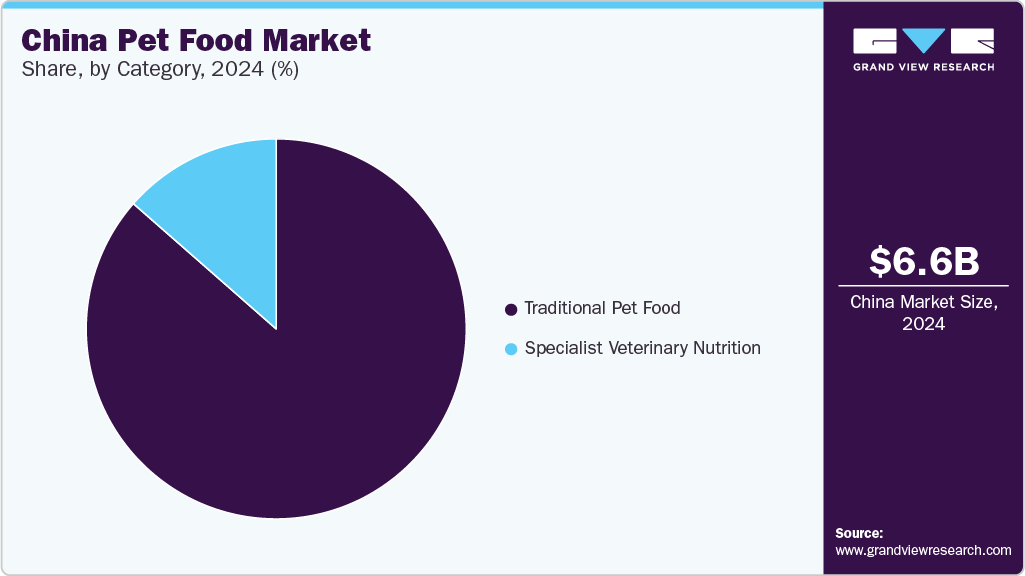

- By category: Traditional pet food for commuters represented 86.5% of the market in 2024, fueled by its affordability, accessibility, and established preference among long-time pet owners.

- By distribution channel: Pet specialty stores captured 31.1% of the revenue share in 2024, offering curated, high-quality, and premium food options tailored to pets’ dietary and health needs, aligned with the premiumization trend.

Order a free sample PDF of the China Pet Food Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 6.64 Billion

- 2030 Projected Market Size: USD 10.10 Billion

- CAGR (2025–2030): 7.3%

Key Companies & Market Share Insights

Pet food producers in China are increasingly leveraging advanced processing technologies—such as vacuum frying, air frying, and freeze-drying—to retain natural nutrients, improve flavor, and reduce oil content. Manufacturers are also adopting innovative packaging solutions, including resealable and biodegradable formats, to enhance convenience and sustainability. Customization is on the rise, with brands offering organic selections, unique flavor blends, and personalized treat/snack packs to meet the diverse preferences of pet owners.

Key Players

- The J.M. Smucker Company

- Nestlé Purina

- Mars, Incorporated

- LUPUS Alimentos

- Total Alimentos

- Hill’s Pet Nutrition, Inc.

- General Mills Inc.

- WellPet LLC

- The Hartz Mountain Corporation

- Diamond Pet Foods

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The China pet food market is expanding rapidly, fueled by rising pet ownership, increasing health awareness, and a shift toward premiumization. With strong demand across all age groups, innovative product development, and widespread e-commerce adoption, the market is poised for sustained growth. Domestic and international brands that focus on nutrition, transparency, and consumer engagement are well-positioned to capture opportunities in this evolving landscape.