Check Credit Score in UK Instantly – A Complete Guide

Check Credit Score in UK Instantly – A Complete Guide

Your credit score is one of the most important financial numbers in your life. Whether you are applying for a mortgage, a personal loan, a credit card, or even renting a flat, lenders and landlords often use your credit score to assess your reliability. The higher your score, the better your chances of getting approved with favorable terms.

But the good news is—you don’t need to wait for days or pay money to know where you stand financially. Today, you can check credit score in uk instantly and for free through various platforms. This complete guide explains what a credit score is, why it matters, and how you can check and improve it.

What is a Credit Score in the UK?

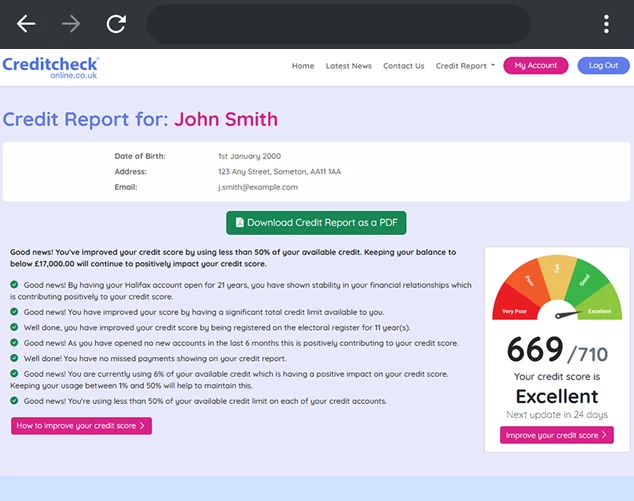

In the UK, a credit score is a three-digit number generated by credit reference agencies (CRAs). It reflects your financial history and predicts how likely you are to repay borrowed money.

There are three major CRAs in the UK:

- Experian – Scores range from 0 to 999.

- Equifax – Scores range from 0 to 1,000.

- TransUnion – Scores range from 0 to 710.

Each agency uses slightly different methods, but the higher your score, the better your financial standing.

Why Should You Check Your Credit Score?

Many people overlook their credit score until they apply for credit and face rejection. By checking it regularly, you can:

- Spot mistakes early – Incorrect information on your credit report can lower your score.

- Monitor fraud and identity theft – Unauthorised accounts or loans in your name can be detected quickly.

- Plan major financial decisions – If you’re preparing for a mortgage or car finance, knowing your score helps you improve it beforehand.

- Boost approval chances – Being aware of your score lets you apply only for products that suit your profile.

How to Check Credit Score in UK Instantly for Free

Here are the best and most trusted ways to check your credit score in the UK:

1. Experian

Experian is the largest CRA in the UK. You can sign up for a free account on their website to see your credit score instantly. They also provide extra insights and tips to help you improve your rating.

2. Equifax

Equifax partners with platforms like ClearScore, where you can access your credit score and full report at no cost. ClearScore updates weekly and gives tailored recommendations for credit cards or loans.

3. TransUnion

TransUnion powers services like Credit Karma (formerly Noddle), offering free and instant access to your score. You can also receive alerts whenever your report changes.

4. Banking & Credit Card Apps

Many UK banks now offer free credit score checks inside their mobile apps. For example, Barclays, NatWest, and Monzo integrate with CRAs to give customers quick access to their score.

5. Annual Free Credit Report

By law, you are entitled to a free annual credit report from each CRA. While this report contains detailed information, using services like ClearScore or Credit Karma allows instant, ongoing access anytime.

Does Checking My Credit Score Affect It?

This is a common myth. Checking your own credit score is considered a soft search, which does not harm your score. Only hard searches—when lenders check your credit after you apply for a loan or credit card—can have a small temporary impact.

What is a Good Credit Score in the UK?

Since each CRA has different scoring systems, here’s a quick breakdown:

- Experian: 881–960 = Good, 961–999 = Excellent.

- Equifax: 420–465 = Good, 466–700 = Excellent.

- TransUnion: 604–627 = Good, 628–710 = Excellent.

If your score is below these ranges, it doesn’t mean you won’t be approved—it just means you may face higher interest rates or stricter conditions.

How to Improve Your Credit Score Quickly

If your credit score isn’t where you want it to be, here are practical tips to improve it:

- ✅ Always pay bills on time – Payment history is the most important factor.

- ✅ Keep credit utilisation low – Aim to use less than 30% of your available credit.

- ✅ Avoid multiple applications – Too many hard searches can reduce your score.

- ✅ Register on the electoral roll – Being registered at your address improves your reliability in lenders’ eyes.

- ✅ Check for mistakes – Correct any errors on your report immediately.

- ✅ Maintain old accounts – Longer credit history helps boost your score.

Final Thoughts

Your credit score is a vital part of your financial profile, and in the UK, you can check it instantly and for free using trusted services like Experian, ClearScore, or Credit Karma. Monitoring your score regularly not only helps you stay aware of your financial health but also gives you the opportunity to fix issues before they affect your ability to borrow.

By taking simple steps like paying bills on time, keeping credit use low, and monitoring your report for errors, you can steadily build a stronger credit score. Start today—check your credit score in the UK instantly, and take control of your financial future.