Biocomposites Market Growth: Technology-Based Applications 2025-2033

The biocomposites market is on a strong growth trajectory as sustainability, performance improvements, and regulatory pressures converge to drive adoption across major industries.

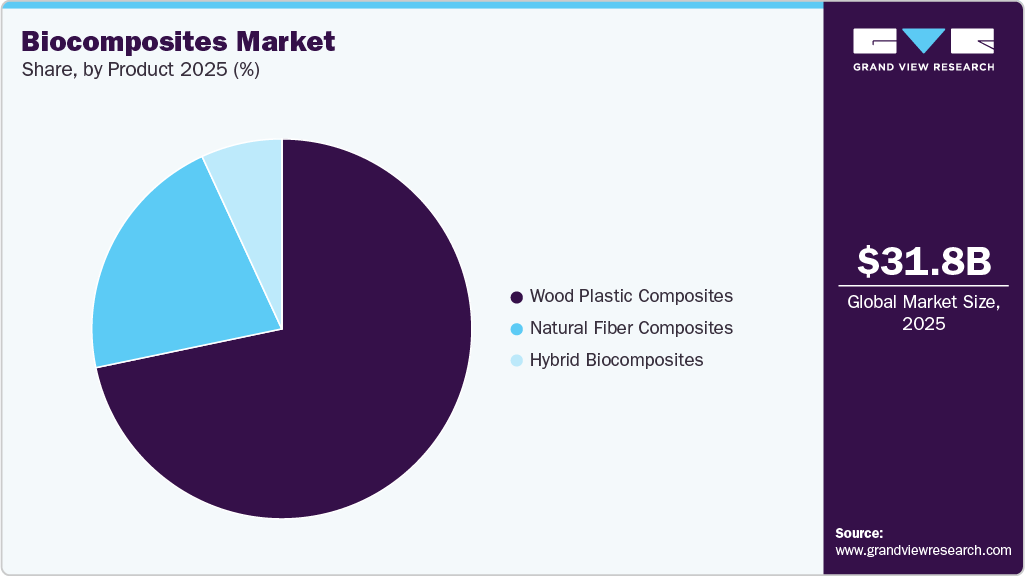

The global biocomposites market size was estimated at USD 28.37 billion in 2024 and is projected to reach USD 79.35 billion by 2033, growing at a CAGR of 12.1% from 2025 to 2033, driven by the worldwide transition toward sustainable, eco-friendly materials across industrial sectors.

As governments, corporations, and consumers work to reduce carbon emissions and dependence on fossil-based plastics, biocomposites have emerged as a renewable and biodegradable alternative to traditional composites. Rising environmental awareness, stricter waste-management regulations, and mounting concerns over microplastics are encouraging industries such as automotive, construction, and packaging to adopt bio-based materials. With sustainability becoming central to product design, biocomposites are increasingly regarded as a preferred material category. At the same time, improvements in supply chains are lowering costs and enhancing production scalability.

Several factors are accelerating this shift, including regulations targeting carbon output and single-use plastics, fluctuating petroleum prices, and growing consumer demand for environmentally responsible products. In the automotive industry, biocomposites support lightweighting and emissions reduction initiatives. Construction companies are turning to bio-based panels and insulation to meet efficiency standards, while packaging manufacturers are adopting biodegradable solutions to align with consumer expectations and regulatory requirements. Innovations in natural fibers—such as hemp, flax, and jute—and advancements in resin systems are boosting mechanical performance, broadening application potential. These developments are further supported by increasing R&D efforts and collaborative projects across academia and industry.

Current market trends include the emergence of high-strength natural fiber-reinforced composites and hybrid bio-synthetic materials. Integrating biocomposites with nanocellulose is enhancing performance for aerospace and electronics applications. Meanwhile, the use of biocomposite filaments in 3D printing is expanding design flexibility in consumer goods. Companies are also creating recyclable bio-resins and thermoplastic biocomposites to improve end-of-life sustainability. Vertical integration is becoming more common as manufacturers cultivate their own raw materials—such as hemp or flax—to secure supply consistency. Startups are also tapping into agricultural waste streams like coconut coir, rice husk, and banana fiber to develop cost-efficient and high-performance natural fillers.

Key Market Trends & Insights

- North America dominated the biocomposites market with the largest revenue share of 50.4% in 2024.

- The Asia Pacific biocomposites industry is expected to grow at the fastest CAGR over the forecast period.

- By product, the hybrid biocomposites segment is expected to grow at the fastest CAGR of 12.9% over the forecast period.

- By technology, the injection molding segment is projected to grow at the fastest CAGR of 13.3% over the forecast period.

- By polymer, the biodegradable polymer segment is anticipated to expand at the fastest CAGR of 12.7% over the forecast period.

Download a free sample PDF of the Biocomposites Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 28.37 Billion

- 2033 Projected Market Size: USD 79.35 Billion

- CAGR (2025–2033): 12.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Competitive Landscape

Key players operating in the market include Stora Enso and Bcomp Ltd.

- Stora Enso is a Finnish-Swedish renewable materials company recognized as one of the leading global providers of wood-based products. The company focuses on sustainable packaging, biomaterials, wooden construction, and paper, and has been investing heavily in bio-based composites and lignin-derived materials to replace fossil-based plastics in automotive, electronics, and industrial applications.

- Bcomp Ltd is a Swiss innovator specializing in natural fiber composites. Its proprietary ampliTex and powerRibs technologies deliver high-performance flax-based materials for automotive interiors, sporting goods, and aerospace components. The company emphasizes sustainability by balancing performance, weight reduction, and environmental benefits.

Emerging participants include UFP Industries, Inc. and Natural Fibre Technologies.

- UFP Industries, headquartered in the United States, is a diversified holding company producing and distributing wood and wood-alternative products across retail, construction, and industrial markets. The company is active in wood-plastic composites, offering long-lasting and eco-friendly outdoor building materials, including decking, fencing, and trim.

- Natural Fibre Technologies is a Canadian company specializing in converting agricultural residues and non-wood plant fibers—such as hemp, flax, and wheat straw—into advanced natural fiber reinforcements. NFT serves automotive, consumer goods, and packaging markets with tailored fiber processing solutions that support sustainable manufacturing goals.

Prominent Companies

- Stora Enso

- UPM Biocomposites

- UFP Industries, Inc.

- Natural Fibre Technologies

- RBT BioComposites

- FiberWood

- Bcomp Ltd

- Jelu-Werk J.Ehrler GmbH

- Hemka

- Norske Skog Saugbrugs

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The biocomposites market is on a strong growth trajectory as sustainability, performance improvements, and regulatory pressures converge to drive adoption across major industries. With rapid advancements in natural fiber technologies, increasing investment in bio-based materials, and expanding applications in automotive, construction, packaging, and emerging sectors, biocomposites are positioned to become a cornerstone of the global shift toward environmentally responsible manufacturing. If you’d like, I can create a shorter, more technical, or more executive-focused conclusion.