Automotive Engine Management System (EMS) Market Innovations: Tech on Track

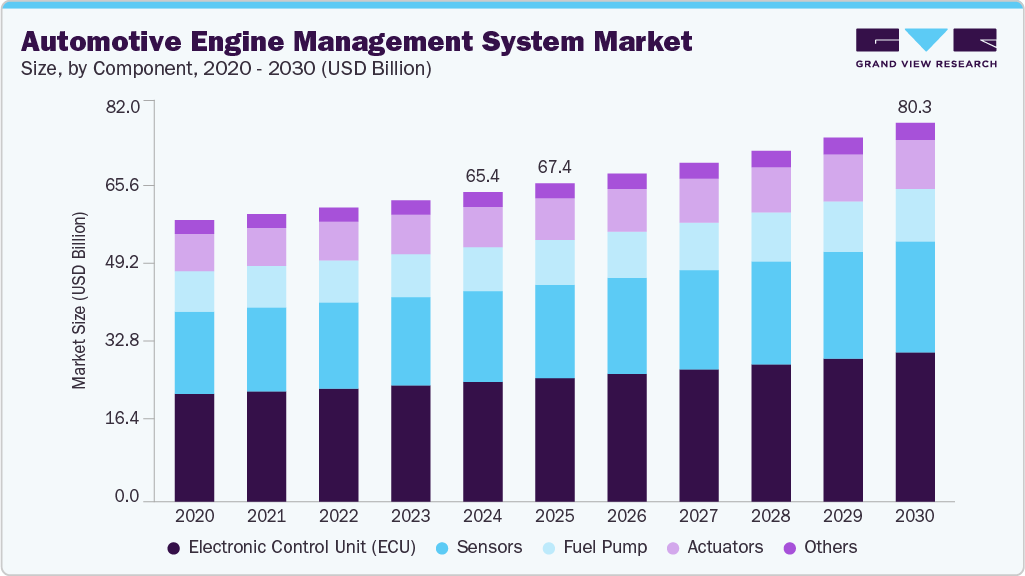

The global automotive engine management system (EMS) market was valued at USD 65.54 billion in 2024 and is projected to reach USD 80.25 billion by 2030.

The global automotive engine management system (EMS) market was valued at USD 65.54 billion in 2024 and is projected to reach USD 80.25 billion by 2030, growing at a CAGR of 3.6% from 2025 to 2030. The market growth is primarily driven by the increasing demand for improved fuel efficiency, lower emissions, and the shift towards alternative and renewable fuels, particularly as part of the global efforts to reduce greenhouse gas emissions and dependency on fossil fuels.

Modern engine management systems are evolving to support alternative fuels such as natural gas, propane, biodiesel, and ethanol, while still maintaining compatibility with traditional internal combustion engines (ICEs). The U.S. Department of Energy highlights that ICEs can efficiently run on these renewable fuels without requiring significant infrastructure modifications. Notably, hydrogen combustion engines represent a key innovation in the EMS market, as demonstrated by Sandia National Laboratories. These engines offer 50% fuel-to-electricity efficiency and near-zero nitrogen oxide (NOx) emissions, making hydrogen a viable transitional fuel for both hybrid vehicles and stationary power applications.

Further advancements in EMS technology are being driven by the integration of hybrid electric powertrains. Hybrid systems combined with internal combustion engines can enhance fuel economy by 25-50%, as indicated by U.S. Department of Energy studies. Notably, initiatives such as the Plug-in Hybrid Electric Vehicle (PHEV) program at Oak Ridge National Laboratory have developed strategies to minimize cold-start emissions, which are a common challenge for hybrid systems. Additionally, new technologies like engine downsizing, turbocharging, and variable valve timing are helping manufacturers improve fuel efficiency without sacrificing vehicle performance.

Key advancements also include the dynamic adjustment of engine parameters, such as air-fuel ratios, ignition timing, and boost pressure, which are controlled by EMS algorithms. For instance, by downsizing a 2.0L engine to 1.4L while incorporating advanced technologies like direct injection and variable valve timing, manufacturers can improve fuel economy by 20% without compromising power output.

Order a free sample PDF of the Automotive Engine Management System Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific: The Asia Pacific region accounted for the largest revenue share of 43.8% in 2024 and is expected to continue growing rapidly. This region’s growth is fueled by increasing urbanization, rising pollution levels, and the acceleration of vehicle electrification. Countries such as Japan, China, and India are adopting stricter emission standards and investing heavily in EMS technologies to comply with both global and domestic regulations. For instance, governments in the region are introducing stricter vehicle inspection programs and promoting research and development of cleaner internal combustion engines integrated with advanced EMS.

- By Component: The electronic control unit (ECU) segment was the largest revenue contributor, accounting for 38.7% of the market share in 2024. As automakers shift towards smarter and more efficient powertrain systems, the demand for advanced ECUs continues to grow. ECUs are increasingly being used in both entry-level and high-end vehicle models due to their role in real-time data processing, fuel optimization, and compliance with stringent emissions regulations. In hybrid and next-gen gasoline engines, ECUs have become central to managing overall energy flows and engine performance.

- By Engine Type: In 2024, the gasoline engine segment dominated the market. The focus within this segment is now shifting towards enhancing emission control and improving fuel economy, with the integration of technologies like turbocharging, direct injection, and variable valve timing becoming more prevalent. As original equipment manufacturers (OEMs) aim to meet regulatory standards such as Euro 6 and China VI, the demand for more sophisticated EMS solutions has increased. Gasoline engines remain particularly popular in North America and Asia-Pacific, driving continued demand for advanced EMS technologies.

- By Vehicle Type: The passenger car segment led the market in 2024, driven by high production volumes and the adoption of newer engine architectures. EMS in passenger vehicles is evolving from a purely functional component to a strategic differentiator that enhances vehicle performance, fuel efficiency, and compliance with global emission standards. Automakers are increasingly investing in AI-powered EMS systems, which enable predictive analytics, reduce maintenance costs, and improve user experience, especially in premium segments.

Market Size & Forecast

- 2024 Market Size: USD 65.54 Billion

- 2030 Projected Market Size: USD 80.25 Billion

- CAGR (2025-2030): 3.6%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Several prominent players are driving innovation and market growth in the automotive EMS industry. These include companies such as Robert Bosch GmbH, Continental AG, Denso Corporation, and BorgWarner Inc. These companies are investing heavily in research and development, focusing on creating advanced ECUs, high-precision sensors, and new software platforms that optimize fuel efficiency, reduce emissions, and comply with regulatory standards. Their established relationships with OEMs, presence across multiple vehicle segments, and ability to scale production have solidified their leadership in the market.

- Continental AG has positioned itself as a leading player in the market by developing intelligent engine control solutions for both traditional ICEs and electrified powertrains. Their expertise in scalable ECUs, high-precision sensors, and real-time data processing is helping automakers improve engine efficiency and meet stringent emissions regulations.

- Denso Corporation, a key member of the Toyota Group, is another major contributor to the global EMS evolution. Denso specializes in developing advanced EMS components such as engine control units, fuel injection systems, and sensors. Their EMS solutions are essential in enhancing vehicle performance while complying with increasingly stringent emission norms.

Key Players

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- BorgWarner Inc.

- Hitachi Astemo, Ltd.

- Valeo

- Infineon Technologies AG

- Sensata Technologies, Inc.

- Niterra Co., Ltd.

- Mitsubishi Heavy Industries Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global automotive engine management system market is set for steady growth, driven by innovations in fuel efficiency, emission reduction technologies, and the shift towards hybrid and alternative fuel-powered vehicles. As governments and industries strive to meet stricter emission regulations, the adoption of advanced EMS technologies will continue to rise, especially in regions like Asia Pacific, where vehicle electrification and emissions standards are evolving rapidly. With the increasing demand for smarter, more efficient powertrain systems, OEMs are investing in cutting-edge EMS solutions, making this an exciting time for the industry. The market will likely see continued growth, especially in passenger cars and gasoline engine segments, as automotive manufacturers focus on optimizing vehicle performance and meeting environmental standards.