Automotive Adhesives Market: Top Firms Driving Cost Efficiency

The automotive adhesives market is poised for robust growth, driven by the industry’s transition toward lightweight vehicles, sustainable manufacturing, and innovative bonding solutions.

The global automotive adhesives market size was valued at USD 8.0 billion in 2024 and is projected to reach USD 13.6 billion by 2030, expanding at a CAGR of 9.3% from 2025 to 2030. Growth is primarily driven by the rising demand for lightweight vehicles. As automakers aim to reduce vehicle weight for improved fuel efficiency and lower emissions, adhesives play a vital role in bonding lightweight materials such as aluminum, carbon fiber, and plastics.

Innovations in adhesive formulations are also fueling market expansion, with strong, versatile, and eco-friendly solutions that enhance vehicle durability, safety, and performance. Their growing application across both traditional and electric vehicles reflects the industry’s move toward advanced bonding technologies.

The market also benefits from rising consumer demand for vehicle customization and cost-efficient manufacturing. Adhesives enable the bonding of diverse materials and provide greater flexibility in design, helping manufacturers offer personalized features. In addition, adhesives present cost-effective alternatives to welding and mechanical fasteners, reducing production costs while streamlining assembly processes.

Technology Insights

- The reactive & others segment held the largest share of 69.9% in 2024, supported by superior bonding properties and versatility. Polyurethane and epoxy-based reactive adhesives are widely used for structural bonding, interior assembly, and glass installation, offering resistance to chemicals, temperature changes, and environmental stress—key factors behind their dominance.

- The water-based adhesives segment is projected to be the fastest-growing, with a CAGR of 10.5% during 2025–2030. This growth is attributed to stricter regulations on volatile organic compounds (VOCs) and rising sustainability initiatives. Offering lower toxicity and safer application, water-based adhesives are increasingly adopted for bonding, sealing, and laminating in automotive production.

Key Market Trends & Insights

- Asia Pacific accounted for the largest share of 50.1% in 2024.

- By technology, the reactive & others segment captured the largest share of 69.9% in 2024.

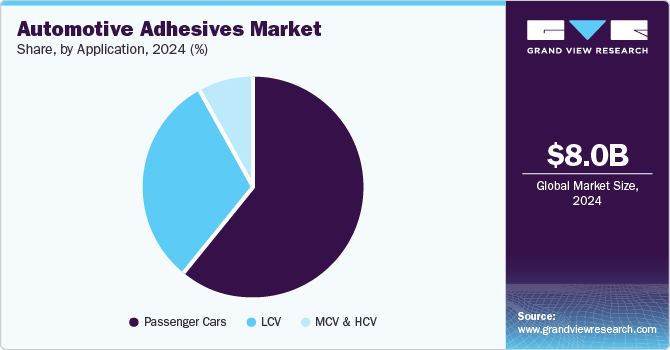

- By application, the passenger cars segment dominated with a 60.9% share in 2024.

Download a free sample PDF of the Automotive Adhesives Market Intelligence Study, published by Grand View Research.

Market Performance

- 2024 Market Size: USD 8.0 Billion

- 2030 Projected Market Size: USD 13.6 Billion

- CAGR (2025–2030): 9.3%

- Asia Pacific: Largest market in 2024

- North America: Fastest-growing market

Prominent Companies & Market Dynamics

The industry is competitive, with global players adopting strategies focused on innovation, sustainability, and expansion into EV-related applications.

- Henkel AG & Co. KGaA provides advanced adhesives, sealants, and coatings aimed at improving performance, durability, and sustainability in automotive manufacturing.

- Dow offers innovative materials, including silicones and adhesives, tailored for electric vehicles, hybrids, and other automotive solutions that enhance safety, efficiency, and sustainability.

Key Companies

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Sika AG

- Dow

- Arkema

- 3M

- BASF

- Illinois Tool Works Inc.

- PPG Industries, Inc.

- Solvay

- Akzo Nobel N.V.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The automotive adhesives market is poised for robust growth, driven by the industry’s transition toward lightweight vehicles, sustainable manufacturing, and innovative bonding solutions. With expanding applications across passenger and electric vehicles, adhesives are set to remain integral to future automotive design and production efficiency.