Australia Wealth Management Market: Industry Trends, Share, Size and Forecast 2025-2033

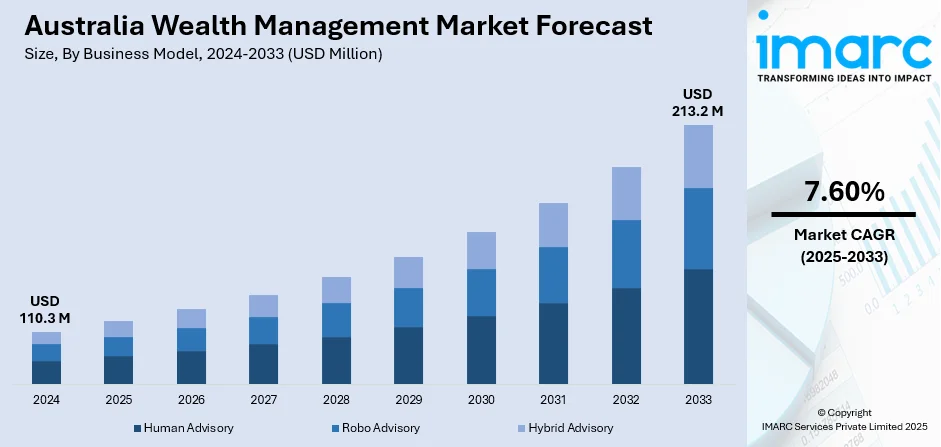

Australia wealth management market size is valued at USD 110.3M 2024, is projected to reach USD 213.2M 2033, growing at a CAGR of 7.60% by 2025-2033.

The latest report by IMARC Group, titled "Australia Wealth Management Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia wealth management market growth. The report also includes competitor and regional analysis, along with detailed segmentation. The Australia wealth management market size reached USD 110.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 213.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025–2033.

Report Attributes:

· Base Year: 2024

· Forecast Years: 2025–2033

· Historical Years: 2019–2024

· Market Size in 2024: USD 110.3 Million

· Market Forecast in 2033: USD 213.2 Million

· Market Growth Rate 2025–2033: 7.60%

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/australia-wealth-management-market/requestsample

How Is AI Transforming the Wealth Management Market in Australia?

- AI is enabling advanced analytics for portfolio optimization and risk management.

- Automation is improving operational efficiency and reducing advisory costs.

- Predictive modeling supports customized investment recommendations.

- AI-driven client engagement tools enhance communication and service personalization.

- Intelligent systems streamline compliance and regulatory reporting.

Australia Wealth Management Market Overview

• The market is growing quickly because more high-net-worth individuals are becoming interested, and the economy is doing well.

• A strong retirement savings system and more people wanting to plan for their future are attracting more customers.

• The use of digital tools like robo-advisors, mobile apps, and data-based investment methods is making financial services easier to access and more engaging for clients.

• New rules, like the Future of Financial Advice (FOFA), are making financial advice more honest, reducing conflicts, and helping investors feel more confident.

• Global connections and tax benefits are creating new ways to invest and helping more people protect and grow their wealth.

Key Features and Trends of Australia Wealth Management Market

• The market is growing quickly because more high-net-worth individuals are becoming interested, and the economy is doing well.

• A strong retirement savings system and more people wanting to plan for their future are attracting more customers.

• The use of digital tools like robo-advisors, mobile apps, and data-based investment methods is making financial services easier to access and more engaging for clients.

• New rules, like the Future of Financial Advice (FOFA), are making financial advice more honest, reducing conflicts, and helping investors feel more confident.

• Global connections and tax benefits are creating new ways to invest and helping more people protect and grow their wealth.

Growth Drivers of Australia Wealth Management Market

• More high-net-worth individuals and ultra-high-net-worth people are needing special financial services.

• The economy is growing strongly, which helps people build more wealth.

• New rules are making things more clear and trustworthy for customers.

• Technology and online tools are making it easier to manage money and wealth.

• More people are asking for help with planning for retirement and passing on their wealth because there are more older people.

Innovation & Market Demand of Australia Wealth Management Market

- Expanding use of robo-advisors and AI-powered personalized investment tools.

- Development of mobile apps simplifying access to wealth management.

- Growing client focus on sustainable and ESG investment products.

- Collaborations between fintech firms and traditional wealth managers accelerating innovation.

- Increasing demand for holistic financial planning covering investments, taxes, and estate.

Australia Wealth Management Market Opportunities

- Expanding affluent population boosting market demand.

- Government incentives for retirement savings and investments.

- Increasing adoption of digital advisory services among younger investors.

- Niche services growth such as ESG and impact investing.

- Expansion into underserved regional markets.

Australia Wealth Management Market Challenges

- Navigating complex regulatory environments while maintaining profitability.

- Balancing personalized service with automation.

- Managing cybersecurity risks associated with digital platforms.

- Competition from fintech startups and new entrants.

- Keeping pace with fast technological changes and evolving client expectations.

Australia Wealth Management Market Analysis

- The market growth is significantly influenced by demographic shifts and wealth concentration.

- Digital transformation and regulatory frameworks are reshaping competitive dynamics.

- Increasing client demand for transparency and comprehensive financial solutions.

- Regional disparities affect the availability and type of wealth management services.

- Collaboration between traditional players and fintech firms is driving innovation.

Australia Wealth Management Market Segmentation:

- By Business Model:

- Human Advisory

- Robo Advisory (Direct Plan-Based/Goal-Based, Comprehensive Wealth Advisory)

- Hybrid Advisory

- By Provider:

- Fintech Advisors

- Banks

- Traditional Wealth Managers

- Others

- By End User:

- High Net Worth Individuals (HNWIs)

- Ultra-High Net Worth Individuals (UHNWIs)

- Corporates

- Others

- By Region:

- Australian Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Wealth Management Market News & Recent Developments:

- July 2025: Increasing adoption of AI-driven advisory tools is reshaping client engagement strategies.

- June 2025: Regulatory bodies are advancing reforms to enhance transparency and protect investor interests.

Australia Wealth Management Market Key Players:

- Macquarie Bank Limited

- National Australia Bank Limited

- Westpac Banking Corporation

- CommBank Group

- Morgan Stanley & Co International plc

- Shadforth Financial Group Limited

- Perpetual Limited

Key Highlights of the Report:

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24704&flag=E

FAQs: Australia Wealth Management Market

Q1: What is the projected market size of the Australia wealth management market by 2033? A: The market is projected to reach USD 213.2 Million by 2033.

Q2: What is the CAGR of the Australia wealth management market from 2025 to 2033? A: The compound annual growth rate (CAGR) is 7.60%.

Q3: What are the main growth drivers of the Australia wealth management market? A: Key growth drivers include increasing HNWIs, regulatory reforms, digital transformation, and strong economic fundamentals.

Q4: Which business models are prevalent in the Australia wealth management market? A: Human advisory, robo advisory, and hybrid advisory models dominate the market.

Q5: How is technology impacting the wealth management sector in Australia? A: Technology such as AI, robo-advisors, and mobile apps is enhancing personalized advice, operational efficiency, and client engagement.

About Us: IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

Contact Us: 134 N 4th St. Brooklyn, NY 11249, USA Email: sales@imarcgroup.com Tel No: (D) +91 120 433 0800 United States: +1-201971-6302