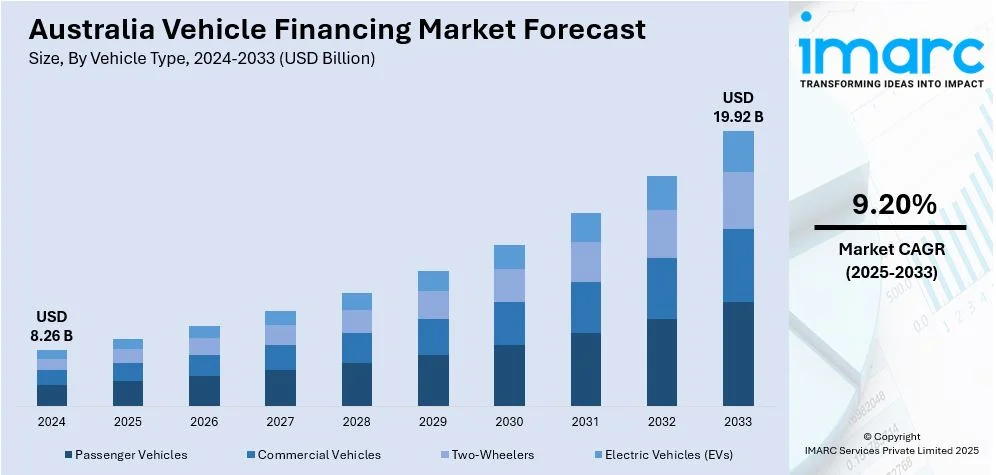

Australia Vehicle Financing Market Projected to Reach USD 19.92 Billion by 2033

The Australia vehicle financing market size reached USD 8.26 Billion in 2024. Looking forward, the market is expected to reach USD 19.92 Billion by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033.

Market Overview

The Australia vehicle financing market was valued at USD 8.26 Billion in 2024, with projections to reach USD 19.92 Billion by 2033. The market is driven by digital innovations, growing demand for used cars, and increased shift towards electric vehicles. Financial institutions are adapting by offering flexible loan terms and EV-focused products, expanding consumer financing accessibility across the country. This sector plays a significant role in automotive transactions within Australia's economy.

For more details, visit the Australia vehicle financing market https://www.imarcgroup.com/australia-vehicle-financing-market

How AI is Reshaping the Future of Australia Vehicle Financing Market

- AI-driven credit scoring is streamlining loan approvals, enhancing accuracy, and providing instant decisions, benefitting tech-savvy customers.

- Biometric authentication powered by AI is increasing security and reducing fraud in vehicle financing applications.

- ASIC's 2025 review on motor finance lenders aims to protect vulnerable groups, supported by AI systems that flag risky loan defaults.

- AI integration in digital platforms has accelerated e-verification and reduced loan processing times significantly.

- Collaboration between NAB and fintech Plenti exemplifies AI-based co-branded loans tailored to green vehicles, promoting sustainable finance.

- AI-powered monitoring tools improve real-time loan tracking and customer satisfaction, expanding reach among rural and first-time buyers.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-vehicle-financing-market/requestsample

Australia Vehicle Financing Market Growth Factors

Urban expansion and rising vehicle ownership needs are key growth drivers in Australia’s vehicle financing market. The population growth and extended urban regions, especially in suburban and regional areas with limited public transport, increase dependence on private vehicles for commuting and errands. This demand pushes consumers to prefer affordable financing options such as vehicle loans and leasing plans that reduce large upfront costs. Consequently, financing availability expands as more individuals seek practical ownership solutions aligned with their mobility requirements.

Technology-driven digital loan processing, including AI-powered credit scoring and biometric authentication, revolutionizes the Australian vehicle financing landscape. These automated platforms enable customers to apply via mobile apps or web portals, facilitating easy document upload, quick credit checks, and e-signing. With support from regulatory bodies like ASIC enhancing consumer protections, the digital shift improves approval speed, transparency, and convenience. This fosters increased loan uptake across demographics, notably among younger, tech-savvy, and rural borrowers.

The rising demand for used and certified pre-owned vehicle financing fuels market growth amid affordability concerns and inflationary pressures. Australian consumers increasingly prefer second-hand vehicles due to cost-effectiveness and retained value. Financial institutions respond by offering longer-term loans and lowered down payments specifically for used cars. Additionally, enhanced vehicle certification programs strengthen buyer confidence. The automation of loan approvals through digital channels further facilitates access to financing, contributing significantly to portfolio growth by asset condition.

Australia Vehicle Financing Market Segmentation

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Electric Vehicles (EVs)

Loan Provider Insights:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Original Equipment Manufacturers (OEMs) Financing

- Credit Unions

- Others

Vehicle Condition Insights:

- New Vehicles

- Used Vehicles

Purpose Type Insights:

- Loan

- Leasing

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Key Players

- Allied Credit

- Chery Australia

- CommBank

- carsales

- Vyro

- NAB

- Plenti

Recent Development & News

- April 2025: CommBank, in partnership with carsales and Vyro, launched a car purchase service via its app featuring electric vehicle discounts and streamlined loan applications, enhancing accessibility to affordable and environmentally conscious vehicle financing.

- July 2025: Allied Credit and Chery Australia established a finance alliance under the Chery Motor Finance marque, introducing customer-centric programs like guaranteed future value to improve vehicle ownership experience and dealer network support nationally.

- August 2025: NAB and Plenti expanded their joint venture, "NAB powered by Plenti," to introduce innovative co-branded loans supporting electric vehicle purchases with bundled insurance and extended repayment plans, further stimulating green vehicle financing.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

https://www.imarcgroup.com/request?type=report&id=35119&flag=F

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302