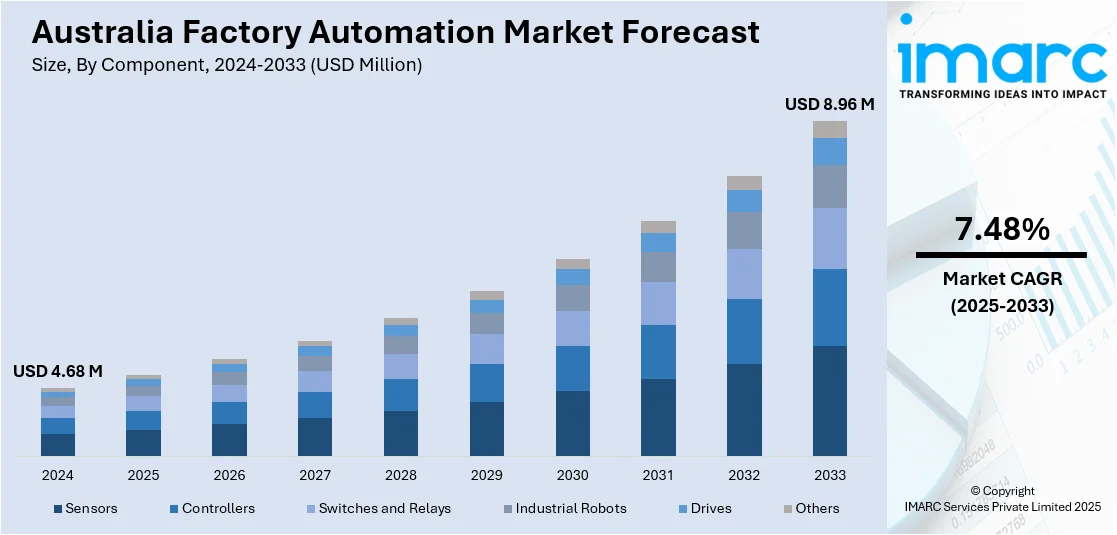

Australia Factory Automation Market Projected to Reach USD 8.96 Million by 2033

The Australia factory automation market size reached USD 4.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8.96 Million by 2033, exhibiting a CAGR of 7.48% during 2025–2033.

The latest report by IMARC Group, titled "Australia Factory Automation Market Report by Component (Sensors, Controllers, Switches and Relays, Industrial Robots, Drives, Others), System Type (Distributed Control System (DCS), Supervisory Control and Data Acquisition System (SCADA), Manufacturing Execution System (MES), Systems Instrumented System (SIS), Programmable Logic Controller (PLC), Human Machine Interface (HMI)), Industry Vertical (Automotive Manufacturing, Food and Beverage, Oil and Gas Processing, Mining, Others), and Region 2025-2033**,"** offers a comprehensive analysis of the Australia factory automation market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia factory automation market size reached USD 4.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8.96 Million by 2033, exhibiting a CAGR of 7.48% during 2025–2033.

The latest report by IMARC Group, titled "Australia Factory Automation Market Report by Component (Sensors, Controllers, Switches and Relays, Industrial Robots, Drives, Others), System Type (Distributed Control System (DCS), Supervisory Control and Data Acquisition System (SCADA), Manufacturing Execution System (MES), Systems Instrumented System (SIS), Programmable Logic Controller (PLC), Human Machine Interface (HMI)), Industry Vertical (Automotive Manufacturing, Food and Beverage, Oil and Gas Processing, Mining, Others), and Region 2025-2033**,"** offers a comprehensive analysis of the Australia factory automation market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia factory automation market size reached USD 4.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8.96 Million by 2033, exhibiting a CAGR of 7.48% during 2025–2033.

Base Year: 2024 Forecast Years: 2025–2033 Historical Years: 2019–2024 Market Size in 2024: USD 4.68 Million Market Forecast in 2033: USD 8.96 Million Market Growth Rate (2025–2033): 7.48%

Australia Factory Automation Market Overview

Australia’s factory automation market is experiencing strong growth, driven by technological innovation, widespread Industry 4.0 adoption, rising safety standards, and a growing focus on operational efficiency across manufacturing industries. The market is advancing with the integration of AI, robotics, Industrial IoT, and smart manufacturing technologies, enabling real-time monitoring, predictive maintenance, and optimized production.

Automation is reshaping traditional manufacturing by introducing intelligent systems, connected devices, and data-driven decision-making, positioning Australia for continued progress in industrial efficiency and innovation.

Australia’s manufacturing base spans mining, automotive, food processing, chemicals, and oil & gas—sectors with a high demand for advanced automation solutions. Backed by a skilled workforce, a mature industrial ecosystem, and a focus on cost-efficiency and quality, the market is seeing rapid adoption of smart factories and digital transformation initiatives. Increasing investment in robotics, intelligent systems, and safety-enhancing technologies underscores the country's strong momentum toward industrial modernization and sustainable growth.

Request For Sample Report: https://www.imarcgroup.com/australia-factory-automation-market/requestsample

Australia Factory Automation Market Trends

• Industry 4.0 integration: Advanced factory automation systems incorporating artificial intelligence, machine learning, and Industrial Internet of Things connectivity enabling smart manufacturing capabilities, real-time data analytics, and optimized production workflows across industrial sectors.

• Intelligent robotics adoption: Growing implementation of sophisticated industrial robots equipped with advanced sensors, vision systems, and autonomous capabilities providing precise manufacturing operations, quality control, and flexible production processes.

• Safety-first automation: Increasing deployment of automated systems specifically designed to minimize human exposure to hazardous environments, dangerous processes, and repetitive tasks while maintaining operational efficiency and regulatory compliance standards.

• Predictive maintenance technologies: Rising adoption of smart monitoring systems utilizing sensors, data analytics, and machine learning algorithms to predict equipment failures, optimize maintenance schedules, and minimize unexpected production downtime events.

• Digital twin implementation: Growing utilization of virtual manufacturing models and simulation technologies enabling optimization of production processes, testing of automation strategies, and enhanced decision-making capabilities before physical implementation.

• Sustainable automation focus: Increasing emphasis on energy-efficient automation solutions, waste reduction technologies, and environmentally conscious manufacturing processes supporting sustainability goals and regulatory compliance requirements.

Market Drivers

• Technological advancement acceleration: Rapid development of artificial intelligence, robotics, and IoT technologies creating opportunities for sophisticated automation systems that enhance manufacturing precision, efficiency, and competitive positioning across industrial sectors.

• Safety regulation compliance: Stringent workplace safety requirements and risk management standards driving adoption of automated systems that reduce human exposure to hazardous conditions, improve safety outcomes, and ensure regulatory adherence.

• Labor shortage challenges: Growing shortage of skilled manufacturing workers and aging workforce demographics creating demand for automation solutions that maintain production capabilities while reducing dependency on manual labor resources.

• Quality consistency demands: Increasing customer expectations for product quality, precision, and reliability driving implementation of automated systems that eliminate human error, ensure consistent output, and maintain stringent quality standards.

• Operational efficiency pressure: Rising competition and cost pressures requiring manufacturers to optimize production processes, reduce waste, minimize downtime, and improve overall equipment effectiveness through advanced automation technologies.

• Smart manufacturing initiatives: Government support for Industry 4.0 adoption, digital transformation programs, and manufacturing modernization creating favorable conditions for factory automation investment and technology deployment across Australian industries.

Challenges and Opportunities

Challenges:

- High capital investment requirements for comprehensive factory automation systems creating financial barriers particularly for small and medium-sized manufacturers with limited budgets and extended payback period expectations

- Technical complexity and integration challenges requiring specialized expertise, extensive training programs, and ongoing technical support creating implementation difficulties for traditional manufacturing operations and legacy systems

- Cybersecurity vulnerabilities associated with connected automation systems requiring robust security measures, regular updates, and comprehensive risk management strategies to protect industrial operations from potential threats

- Workforce displacement concerns and skills gap challenges requiring retraining programs, change management initiatives, and adaptation strategies to ensure successful technology adoption and employee engagement

- System compatibility issues with existing manufacturing equipment requiring custom integration solutions, retrofitting investments, and comprehensive compatibility assessments complicating automation deployment processes

Opportunities:

- Smart manufacturing leadership through advanced automation solutions incorporating AI, machine learning, and IoT technologies creating competitive advantages and positioning Australian manufacturers as global technology adopters

- Export market potential for Australian automation expertise serving international manufacturing sectors seeking reliable solutions suited for demanding operational conditions and sophisticated industrial applications

- Sustainable manufacturing differentiation through energy-efficient automation systems, waste reduction technologies, and environmentally conscious production processes addressing sustainability requirements and regulatory compliance

- Service sector expansion including maintenance contracts, system optimization services, remote monitoring solutions, and technical support programs providing recurring revenue streams and enhanced customer relationships

- Mining industry specialization leveraging Australia's mining expertise to develop specialized automation solutions for extreme conditions, heavy-duty applications, and remote operations requiring exceptional reliability and performance

Australia Factory Automation Market Segmentation

By Component:

- Sensors

- Controllers

- Switches and Relays

- Industrial Robots

- Drives

- Others

By System Type:

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition System (SCADA)

- Manufacturing Execution System (MES)

- Systems Instrumented System (SIS)

- Programmable Logic Controller (PLC)

- Human Machine Interface (HMI)

By Industry Vertical:

- Automotive Manufacturing

- Food and Beverage

- Oil and Gas Processing

- Mining

- Others

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Browse Full Report: https://www.imarcgroup.com/australia-factory-automation-market

Australia Factory Automation Market News

• 2024: Priestley Gourmet Delights launched advanced 7,500 m² automated facility in Acacia Ridge, Queensland, featuring AI-enhanced automation and self-operating robots developed by Mexx Engineering, supported by $2.5 million Made in Queensland grant.

• 2024: Dematic introduced comprehensive end-to-end automation solution at Australian meat processing plant featuring Multishuttle Meat Buffer systems with freezer-rated automated guided vehicles designed for cold storage environments.

• 2024: Industry 4.0 adoption accelerated across Australian manufacturing sectors with increased implementation of IoT connectivity, artificial intelligence integration, and smart factory technologies enhancing operational efficiency and productivity.

• 2024: Safety-focused automation deployment expanded in hazardous industries including mining, chemicals, and food processing, reducing human exposure to dangerous environments while improving operational precision and regulatory compliance.

• 2024: Digital transformation initiatives gained momentum with manufacturers implementing predictive maintenance systems, real-time monitoring capabilities, and data analytics solutions supporting optimized production processes and reduced downtime.

Key Highlights of the Report

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- Industry Catalysts and Challenges

- Segment-wise historical and future forecasts

- Competitive Landscape and Key Player Analysis

- Component, System Type, and Industry Vertical Analysis

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=35738&flag=F

Q&A Section

Q1: What drives growth in the Australia factory automation market? A1: Market growth is driven by technological advancement acceleration through AI and robotics integration, safety regulation compliance requiring automated solutions for hazardous environments, labor shortage challenges creating demand for automated production capabilities, quality consistency demands ensuring product reliability, operational efficiency pressure optimizing manufacturing processes, and smart manufacturing initiatives supported by government programs promoting Industry 4.0 adoption.

Q2: What are the latest trends in this market? A2: Key trends include Industry 4.0 integration with AI and IoT connectivity enabling smart manufacturing, intelligent robotics adoption providing precise autonomous operations, safety-first automation minimizing human exposure to hazardous conditions, predictive maintenance technologies utilizing data analytics for optimization, digital twin implementation enabling virtual manufacturing models, and sustainable automation focus supporting environmental consciousness and regulatory compliance.

Q3: What challenges do companies face? A3: Major challenges include high capital investment requirements creating financial barriers for smaller manufacturers, technical complexity and integration challenges demanding specialized expertise and training, cybersecurity vulnerabilities requiring robust security measures and risk management, workforce displacement concerns necessitating retraining and change management programs, and system compatibility issues with existing equipment requiring custom integration solutions.

Q4: What opportunities are emerging? A4: Emerging opportunities include smart manufacturing leadership through advanced AI and IoT-enabled automation systems, export market potential leveraging Australian expertise for international manufacturing sectors, sustainable manufacturing differentiation through energy-efficient and environmentally conscious automation technologies, service sector expansion with maintenance contracts and monitoring solutions, and mining industry specialization developing automation solutions for extreme conditions and remote operations.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us

IMARC Group 134 N 4th St. Brooklyn, NY 11249, USA Email: sales@imarcgroup.com Tel No: (D) +91-120-433-0800 United States: +1-201-971-6302