Australia Courier, Express and Parcel Market Projected to Reach USD 17.7 Billion by 2033

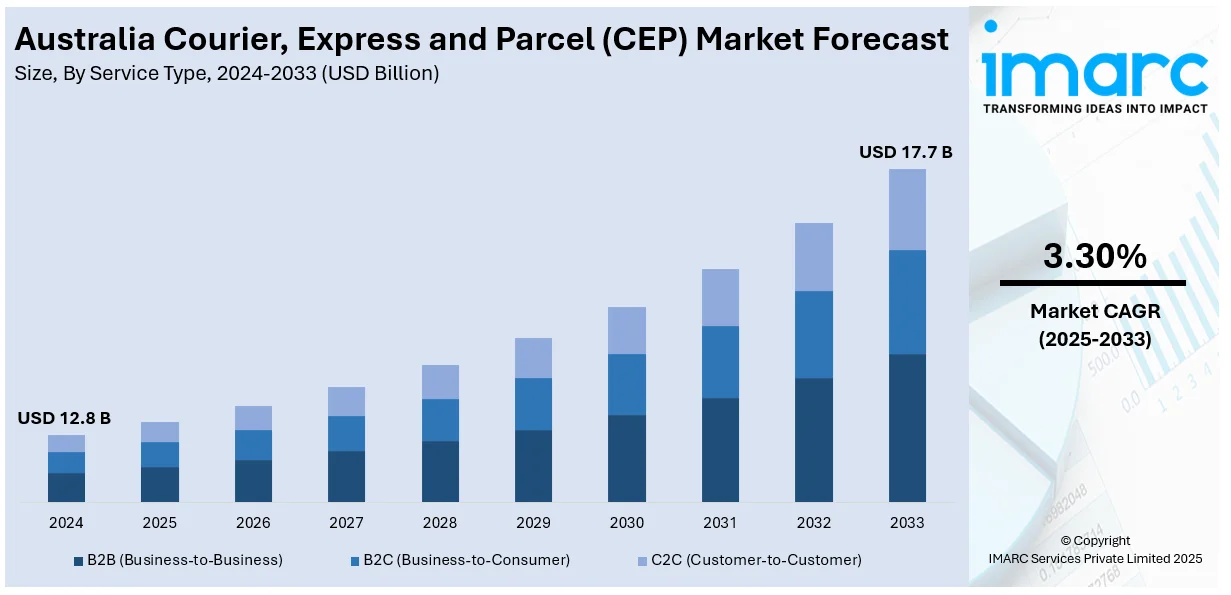

The Australia courier, express and parcel market size reached USD 12.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.7 Billion by 2033, exhibiting a CAGR of 3.30% during 2025–2033. Base Year: 2024

The latest report by IMARC Group, titled "Australia Courier, Express and Parcel Market Report by Service Type (B2B, B2C, C2C), Destination (Domestic, International), Type (Air, Ship, Subway, Road), End Use Sector (Services, Wholesale and Retail Trade, Manufacturing, Construction and Utilities, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia courier, express and parcel market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia courier, express and parcel market size reached USD 12.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.7 Billion by 2033, exhibiting a CAGR of 3.30% during 2025–2033.

The latest report by IMARC Group, titled "Australia Courier, Express and Parcel Market Report by Service Type (B2B, B2C, C2C), Destination (Domestic, International), Type (Air, Ship, Subway, Road), End Use Sector (Services, Wholesale and Retail Trade, Manufacturing, Construction and Utilities, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia courier, express and parcel market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia courier, express and parcel market size reached USD 12.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.7 Billion by 2033, exhibiting a CAGR of 3.30% during 2025–2033.

Base Year: 2024 Forecast Years: 2025–2033 Historical Years: 2019–2024 Market Size in 2024: USD 12.8 Billion Market Forecast in 2033: USD 17.7 Billion Market Growth Rate (2025–2033): 3.30%

Australia Courier, Express and Parcel Market Overview

Australia’s Courier, Express, and Parcel (CEP) market is experiencing steady growth, fueled by the rapid expansion of e-commerce, rising consumer expectations for fast and reliable deliveries, and a strong industry shift toward sustainable logistics. The integration of advanced technologies—including artificial intelligence, robotics, and automation—is streamlining operations and boosting customer satisfaction. Major players, such as Coles, are investing in AI-powered fulfillment centers capable of processing over 10,000 orders daily. Additionally, the market benefits from post-pandemic shifts toward online shopping and growing adoption of green logistics practices, such as electric delivery vehicles and recyclable packaging.

The country's CEP sector is built on a robust logistics infrastructure, supporting B2B, B2C, and C2C delivery models across both domestic and international routes. Australia's extensive transportation network—including road, air, and maritime systems—serves critical industries such as retail, manufacturing, finance, and construction. Rising environmental awareness, increasing automation, and the growth of online commerce are generating favorable conditions for long-term investment in smart logistics, electric fleets, and sustainable packaging. Australia's strategic location in the Asia-Pacific, combined with cutting-edge delivery technologies and evolving consumer expectations, positions its CEP market for continued innovation and operational excellence.

Request For Sample Report: https://www.imarcgroup.com/australia-courier-express-parcel-market/requestsample

Australia Courier, Express and Parcel Market Trends

• Technological automation advancement: Integration of AI, IoT, and robotics transforming logistics operations with Coles' Wetherill Park center employing advanced robotics processing 10,000+ daily orders for five million customers enhancing accuracy and speed.

• E-commerce volume explosion: Rapid growth in online shopping particularly post-pandemic driving increased parcel volumes and consumer expectations for faster, more convenient delivery solutions across all market segments.

• Sustainability implementation: Comprehensive adoption of eco-friendly practices including electric delivery vehicles, optimized routing systems, and recyclable packaging with Amazon eliminating 3 million tonnes of unnecessary packaging since 2015.

• Last-mile innovation: Development of advanced delivery solutions including warehouse robots, drones, and autonomous vehicles reducing operational errors, lowering costs, and improving customer service efficiency.

• Real-time tracking integration: Enhanced transparency through live tracking tools enabling customers to monitor packages throughout delivery process while predictive analytics optimizes routing for faster, cost-effective shipments.

• Green logistics transformation: Australia Post expanding electric vehicle fleet supporting environmentally responsible deliveries responding to regulatory pressure and consumer demand for sustainable service options.

Market Drivers

• E-commerce growth acceleration: Post-pandemic surge in online shopping creating substantial increases in parcel volumes requiring expanded delivery networks, enhanced logistics infrastructure, and improved operational efficiency to meet consumer demands.

• Technology integration demand: Consumer expectations for fast, reliable service driving adoption of AI-powered fulfillment centers, automated sorting systems, and advanced tracking capabilities improving delivery accuracy and customer satisfaction.

• Sustainability regulatory pressure: Government initiatives promoting carbon emission reduction compelling CEP providers to invest in electric vehicles, sustainable packaging, and green logistics practices creating new market opportunities.

• Consumer convenience expectations: Growing demand for faster delivery times, flexible scheduling, and real-time tracking pushing logistics providers to enhance service quality and operational capabilities across all delivery segments.

• Business logistics requirements: Corporate need for reliable B2B delivery services supporting manufacturing, retail trade, banking, and construction sectors requiring specialized logistics solutions and supply chain optimization.

• Geographic coverage expansion: Australia's vast geographic area and dispersed population creating demand for comprehensive domestic and international delivery networks utilizing multiple transportation modes for optimal service.

Challenges and Opportunities

Challenges:

- Geographic distribution complexity across Australia's vast territory with dispersed population centers requiring extensive logistics networks and increased operational costs for comprehensive service coverage

- Infrastructure capacity constraints in peak periods during shopping seasons and promotional events creating potential delivery delays and customer service challenges

- Labor shortage issues affecting driver availability and warehouse operations particularly in remote areas limiting service expansion and operational efficiency

- Regulatory compliance requirements across different states and territories creating administrative complexity and operational standardization challenges

- Cost pressure from competitive pricing while maintaining service quality and investing in technology upgrades and sustainability initiatives affecting profit margins

Opportunities:

- Same-day delivery expansion leveraging urban concentration and advanced logistics technology to capture premium service segments and meet growing consumer expectations for immediate gratification

- Rural and regional market penetration addressing underserved areas through innovative delivery solutions, partnerships with local businesses, and technology-enabled service optimization

- Cross-border e-commerce growth capitalizing on international online shopping trends and Australia's strategic Asia-Pacific location for regional logistics hub development

- Sustainable logistics leadership through comprehensive green initiatives including renewable energy, carbon-neutral operations, and circular economy practices attracting environmentally conscious customers

- Technology partnership opportunities collaborating with fintech, retailers, and technology companies to develop integrated delivery solutions, payment systems, and customer experience enhancements

Australia Courier, Express and Parcel Market Segmentation

By Service Type:

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- C2C (Customer-to-Customer)

By Destination:

- Domestic

- International

By Type:

- Air

- Ship

- Subway

- Road

By End Use Sector:

- Services (BFSI - Banking, Financial Services and Insurance)

- Wholesale and Retail Trade (E-commerce)

- Manufacturing

- Construction and Utilities

- Others

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Browse Full Report: https://www.imarcgroup.com/australia-courier-express-parcel-market

Australia Courier, Express and Parcel Market News (2024–2025)

• 2024: Coles invested in AI-powered fulfillment center at Wetherill Park, Sydney, employing advanced robotics to process over 10,000 orders daily, enhancing order accuracy and delivery speed for five million customers.

• 2024: Amazon continued sustainable packaging initiatives replacing single-use plastics with recyclable paper and cardboard, eliminating approximately 3 million tonnes of unnecessary packaging since 2015.

• 2024: Australia Post expanded electric vehicle fleet deployment supporting greener deliveries and carbon emission reduction goals responding to government environmental initiatives and consumer sustainability preferences.

• 2024: E-commerce parcel volumes continued post-pandemic growth trajectory with consumers maintaining increased online shopping behaviors creating sustained demand for efficient delivery solutions across all sectors.

• 2024: Warehouse automation adoption accelerated with robotics, drones, and autonomous vehicle integration reducing operational errors, lowering costs, and improving customer service efficiency across major logistics providers.

Key Highlights of the Report

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- Industry Catalysts and Challenges

- Segment-wise historical and future forecasts

- Competitive Landscape and Key Player Analysis

- Service Type, Destination, Type, and End Use Sector Analysis

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=31799&flag=F

Q&A Section

Q1: What drives growth in the Australia courier, express and parcel market? A1: Market growth is driven by e-commerce growth acceleration with post-pandemic online shopping surges, technology integration demand for AI-powered systems and automated tracking, sustainability regulatory pressure promoting green logistics practices, consumer convenience expectations for faster delivery and real-time tracking, business logistics requirements across multiple sectors, and geographic coverage expansion addressing Australia's vast territory.

Q2: What are the latest trends in this market? A2: Key trends include technological automation advancement with AI and robotics integration, e-commerce volume explosion creating increased parcel demands, sustainability implementation through electric vehicles and recyclable packaging, last-mile innovation using drones and autonomous vehicles, real-time tracking integration enhancing customer transparency, and green logistics transformation with Australia Post expanding EV fleets.

Q3: What challenges do companies face? A3: Major challenges include geographic distribution complexity across Australia's vast territory requiring extensive networks, infrastructure capacity constraints during peak shopping periods, labor shortage issues affecting driver availability particularly in remote areas, regulatory compliance requirements across different states creating administrative complexity, and cost pressure from competitive pricing while maintaining service quality and technology investments.

Q4: What opportunities are emerging? A4: Emerging opportunities include same-day delivery expansion leveraging urban concentration and advanced technology, rural and regional market penetration addressing underserved areas through innovative solutions, cross-border e-commerce growth capitalizing on Asia-Pacific location advantages, sustainable logistics leadership through comprehensive green initiatives, and technology partnership opportunities with fintech and retail companies for integrated solutions.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us

IMARC Group 134 N 4th St. Brooklyn, NY 11249, USA Email: sales@imarcgroup.com Tel No: (D) +91-120-433-0800 United States: +1-201-971-6302