Anti-obesity Medication Market: A Global Perspective on Demand

The global anti-obesity medication market was valued at USD 6.62 billion in 2023 and is expected to grow to USD 77.24 billion by 2030.

The global anti-obesity medication market was valued at USD 6.62 billion in 2023 and is expected to grow to USD 77.24 billion by 2030, registering a CAGR of 31.66% from 2024 to 2030. The market growth is primarily driven by increasing awareness of the health risks associated with obesity and the rising demand for effective weight loss solutions.

The acceleration in the development of anti-obesity drugs, supported by significant investments in research and development (R&D), is expected to fuel market growth. Advancements in drug development technologies are further enhancing the effectiveness of treatments, addressing the growing global challenge of overweight and obesity-related health issues.

According to the World Obesity Atlas 2022, global obesity rates are projected to rise sharply, with around 1 billion people expected to be living with obesity by 2030. This alarming trend, particularly in low- and middle-income countries, places a heavy burden on healthcare systems and economies worldwide. The report stresses the urgent need for coordinated action to address the root causes of obesity and mitigate its impact, which will create opportunities for pharmaceutical companies and healthcare providers. With healthcare costs related to obesity rising, the need for innovative solutions to curb the epidemic has never been more critical.

Pharmaceutical companies are actively investing in R&D to develop innovative weight management medications. For example, Novo Nordisk completed a phase 2 clinical trial for CagriSema in August 2022, demonstrating its potential for managing type 2 diabetes and obesity. Other promising drugs in development include Oral Sema Obesity and GELA, which are in phase 3 and phase 2 trials, respectively. Eli Lilly's phase 2 trial results for orforglipron in June 2023 also showed significant weight reduction and improved A1C in adults with obesity and type 2 diabetes, further boosting market optimism. If confirmed in phase 3 trials, these findings could broaden the range of available treatments and increase competition, stimulating further innovation.

Order a free sample PDF of the Anti-obesity Medication Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America held the largest share of the global anti-obesity medication market, accounting for 37.67% of the revenue in 2023. This dominance is driven by factors such as the high prevalence of obesity and supportive government policies. Major market players, including Novo Nordisk, Pfizer, Merck & Co., and F. Hoffmann-La Roche, further solidify North America's position. Strategic initiatives such as mergers, acquisitions, and partnerships are also shaping the competitive landscape.

- Product Insights: The approved product segment held the largest revenue share in 2023 and is expected to grow at a CAGR of 32.41% from 2024 to 2030. This dominance is due to the availability of clinically effective and FDA-approved medications such as Zepbound, Wegovy, Saxenda, Orlistat, and Qsymia. These medications have undergone rigorous clinical trials and are specifically designed for weight-related medical conditions, ensuring their safety and efficacy. The approval of new medications and strategic product launches are driving the adoption of these treatments.

- Mechanism of Action: The peripherally acting anti-obesity drugs segment dominated the market, accounting for 59.87% of the revenue in 2023. These drugs work by blocking the absorption of fats in the intestines, which reduces calorie intake and promotes weight loss. This mechanism of action also helps promote a feeling of fullness, without the side effects associated with appetite suppressants. The effectiveness of these drugs, along with their less reliance on physical activity or calorie restriction, makes them appealing to patients seeking sustainable weight management solutions.

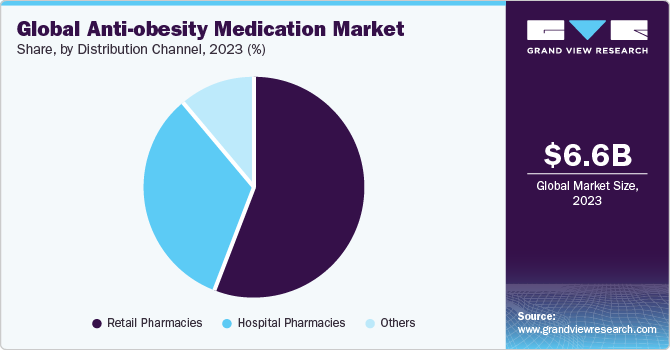

- Distribution Channel: The retail pharmacies segment led the market in 2023, holding a revenue share of 55.90%. Retail pharmacies offer convenient access to medications, often in easily accessible community locations. This makes them a trusted environment for patients seeking treatment for obesity and overweight, as they can fill prescriptions and receive advice from pharmacists on medication use and lifestyle changes.

Market Size & Forecast

- 2023 Market Size: USD 6.62 Billion

- 2030 Projected Market Size: USD 77.24 Billion

- CAGR (2024-2030): 31.66%

- North America: Largest market in 2023

Key Companies & Market Share Insights

Leading players in the anti-obesity medication market include Novo Nordisk A/S, GlaxoSmithKline plc, Novartis AG, VIVUS LLC, Currax Pharmaceuticals, and Kintai Therapeutics. These companies are adopting various strategies to strengthen their market positions, including expanding their market presence through agreements with other players in emerging economies and pursuing product approvals.

Emerging companies such as Rhythm Pharmaceuticals, Inc. and Boehringer Ingelheim International GmbH are also taking strategic initiatives like collaborations and partnerships with key industry players to enhance their presence. They are also focusing on niche areas of the supply chain, such as distribution and delivery of anti-obesity solutions.

Key Players

- Novo Nordisk A/S

- GlaxoSmithKline plc

- Novartis AG

- VIVUS LLC

- Currax Pharmaceuticals

- Kintai Therapeutics

- Boehringer Ingelheim International GmbH

- Rhythm Pharmaceuticals, Inc.

- Gelesis

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The anti-obesity medication market is poised for rapid growth, driven by the increasing global prevalence of obesity, advancements in drug development, and a growing focus on sustainable weight management solutions. North America continues to dominate the market, while emerging companies and innovative treatment options are expected to further propel market expansion. As healthcare costs associated with obesity continue to rise, the demand for effective, FDA-approved medications will increase, creating significant opportunities for pharmaceutical companies. The ongoing research, product development, and regulatory advancements will likely foster a competitive landscape and fuel the market's robust growth, offering hope for tackling the global obesity epidemic.