Anti-drone Market 2033: A Comprehensive Analysis of Defense Tactics

The global anti-drone market was valued at USD 3,180.9 million in 2025 and is forecast to grow to USD 19,844.5 million by 2033.

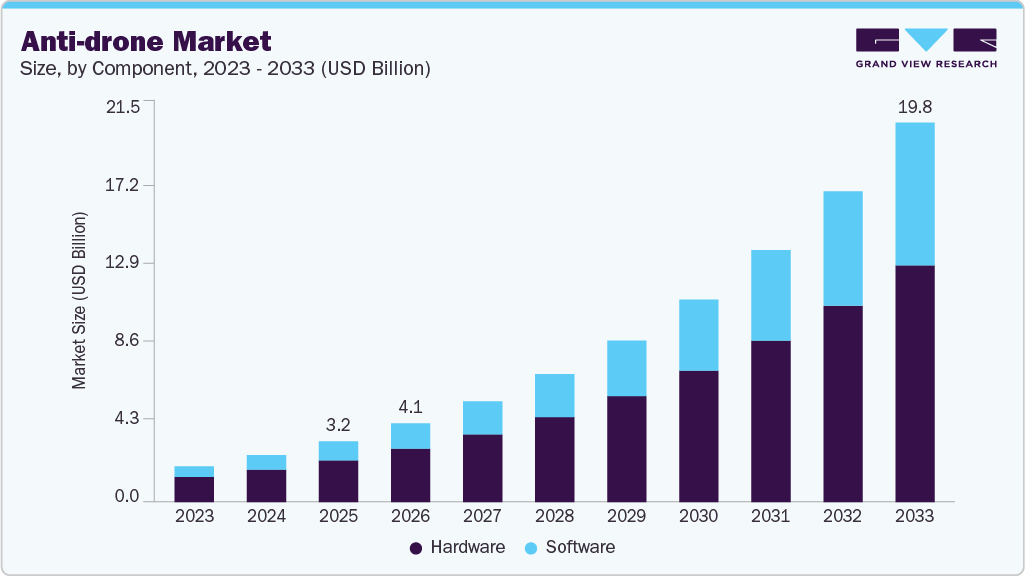

The global anti-drone market was valued at USD 3,180.9 million in 2025 and is forecast to grow to USD 19,844.5 million by 2033, with a CAGR of 25.2% from 2026 to 2033. This rapid expansion is driven by the increasing adoption of unmanned aerial vehicle (UAV) technologies and growing concerns over security risks posed by unauthorized drone activities.

The proliferation of drones has raised significant security concerns, particularly in high-risk areas such as military installations, airports, and public events. Governments and organizations are investing significantly in anti-drone technologies to address these risks, which is expected to further propel the market. Innovations in drone technology, including AI-powered systems and advanced sensors, are also driving the development of more effective anti-drone solutions. These solutions include jamming devices, laser systems, and net-based capture mechanisms, all designed to neutralize drone threats without collateral damage. Such advancements are essential for the effective detection and neutralization of rogue drones, stimulating ongoing innovation within the industry.

Artificial intelligence (AI) and machine learning technologies are increasingly integrated into anti-drone systems, enhancing the accuracy and efficiency of identifying and tracking rogue drones by analyzing flight patterns and behaviors in real time. There is also a growing trend toward multi-layered defense strategies, combining different countermeasures for comprehensive protection against various drone threats. Additionally, partnerships between government agencies and private companies are on the rise, focusing on joint research and development efforts to improve anti-drone technologies.

Governments worldwide are establishing regulatory frameworks for drone operations while promoting the development of countermeasures. For example, regulations requiring airports to implement anti-drone systems have created significant market opportunities for solution providers. Furthermore, international collaborations focused on standardizing counter-drone technologies are expected to drive market growth by ensuring system interoperability.

Order a free sample PDF of the Anti-drone Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America dominated the global anti-drone market in 2025, holding the largest revenue share of over 44%. This dominance is driven by heightened security concerns, particularly regarding the threat to critical infrastructure and public safety posed by unauthorized drones. The increasing use of drones across industries such as gaming, entertainment, retail, and education has amplified demand for reliable anti-drone systems to mitigate risks like surveillance or sabotage.

- Component Insights: The hardware segment accounted for the largest market share, over 68%, in 2025. This is due to the essential role that hardware components like sensors, radars, and jammers play in detecting and neutralizing unauthorized drones. With increasing security incidents related to drones, governments and military organizations are investing heavily in hardware solutions to strengthen defense systems, thus fueling growth in this segment.

- Type Insights: The ground-based anti-drone systems led the market, holding over 58% of the revenue share in 2025. Ground-based solutions are particularly valued for their immediate response capabilities, especially in sensitive areas such as military bases and critical infrastructure. The versatility of these systems also makes them a popular choice for event security and border protection.

- Range Insights: The less than 5 km segment dominated the market, with over 59% revenue share in 2025. These short-range systems are ideal for urban environments and are particularly effective in critical infrastructure protection, public events, and densely populated areas, where rapid response times are crucial.

- Technology Insights: The thermal imaging segment is expected to register the fastest CAGR from 2026 to 2033. The growing adoption of thermal imaging technology is driven by its ability to detect drones under various environmental conditions, including low-visibility scenarios. As the demand for comprehensive surveillance solutions rises, thermal imaging is becoming an essential component in anti-drone systems.

- Mitigation Type Insights: The destructive mitigation segment was the largest in 2025, due to its effectiveness in quickly neutralizing drone threats in high-stakes situations. Destructive countermeasures are preferred in scenarios where immediate action is needed to prevent potential security breaches or harm.

- Defense Type Insights: The drone detection & disruption systems segment led the market in 2025. This growth is attributed to the integrated capabilities of these systems, which provide effective detection and neutralization of drone threats. Organizations are increasingly investing in solutions that combine both detection and disruption features for comprehensive security.

- End-Use Insights: The commercial segment is expected to grow at the fastest CAGR from 2026 to 2033. As drones are increasingly used across various industries, businesses are becoming more aware of the risks posed by unauthorized drone activities, leading to a growing demand for commercial anti-drone solutions.

Market Size & Forecast

- 2025 Market Size: USD 3,180.9 Million

- 2033 Projected Market Size: USD 19,844.5 Million

- CAGR (2026-2033): 25.2%

- North America: Largest market in 2025

Key Companies & Market Share Insights

Major players in the global anti-drone market include Lockheed Martin Corporation, Thales Group, and Raytheon Company.

- Lockheed Martin: A global leader in aerospace, defense, and advanced technologies, Lockheed Martin operates across multiple segments, including Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space. The company is known for its advanced military systems, including the F-35 fighter jet and missile defense systems.

- Thales Group: Specializing in aerospace, defense, transportation, and security, Thales focuses on providing critical infrastructure protection, cybersecurity, air traffic management, and communication systems. The company's diverse product range includes radar systems, avionics for aircraft, and transportation solutions.

Emerging companies in the anti-drone market include Blighter Surveillance Systems, Dedrone, and DeTect, Inc..

- Blighter Surveillance Systems: A UK-based company, Blighter specializes in electronic-scanning radars and surveillance solutions. Their anti-drone systems are designed to detect, track, and classify drones in various environments, offering real-time situational awareness to security forces.

- Dedrone: A global leader in airspace security, Dedrone offers anti-drone solutions to protect critical infrastructure, government facilities, and private properties. The company combines RF sensors, cameras, and AI-based software to detect and mitigate unauthorized drone incursions.

Key Players

- Advanced Radar Technologies S.A.

- Airbus Group SE

- Blighter Surveillance Systems

- Dedrone

- DeTect, Inc.

- Droneshield LLC

- Enterprise Control Systems

- Israel Aerospace Industries Ltd. (IAI)

- Liteye Systems, Inc.

- Lockheed Martin Corporation

- Orelia

- Prime Consulting and technologies

- Raytheon Company

- Saab Ab

- Selex Es Inc.

- Thales Group

- The Boeing Company

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global anti-drone market is on a steep growth trajectory, fueled by rising security concerns and rapid advancements in drone technology. With governments and organizations heavily investing in counter-drone systems, innovations such as AI, thermal imaging, and multi-layered defense strategies are driving the market forward. North America remains the dominant region, but the market is expected to expand rapidly worldwide, particularly in commercial applications. As the threat posed by unauthorized drones continues to grow, the demand for effective, integrated anti-drone systems will only intensify, offering significant opportunities for solution providers across various industries.