Animal Vaccines Market Experiences Steady Growth in Emerging Economies

The global animal vaccines market is poised for robust growth, supported by rising livestock populations, expanding disease prevention programs, and growing awareness of zoonotic threats.

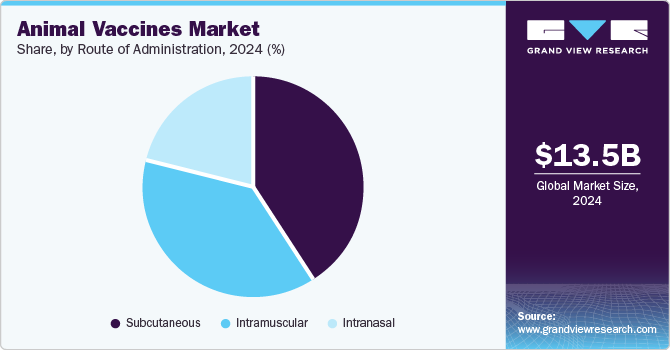

The global animal vaccines market size was estimated at USD 13.48 billion in 2024 and is projected to reach USD 22.95 billion by 2030, growing at a CAGR of 9.5% from 2025 to 2030. The rising incidence of cattle disease outbreaks and the expanding livestock population are key factors driving the global adoption of animal vaccines, particularly for ruminants such as cattle.

Additionally, increasing government initiatives are playing a vital role in promoting market growth. These programs are focused on enhancing animal welfare, ensuring food safety, controlling the spread of diseases, and advancing sustainable agriculture. For instance, in February 2025, Biovet—a division of Bharat Biotech Group—announced that its BIOLUMPIVAXIN vaccine for preventing lumpy skin disease in dairy calves and buffaloes was approved by India’s Central Drug Standard Control Organization (CDSCO).

Growing concerns over food security and the rising adoption of animal husbandry practices are fueling the demand for vaccines across the livestock population. Increasing consumption of animal-based products has boosted livestock production globally. According to OECD projections, global pork meat consumption is expected to rise from 112.58 megatons in 2022 to 127.27 megatons by 2029. Furthermore, cow milk accounts for over 80% of global milk production, with India and Pakistan projected to contribute over 30% of total output by 2029. These trends, coupled with the emergence of new animal diseases and technological advancements in vaccine development, are accelerating market growth.

The growing prevalence of zoonotic diseases, which can affect both animals and humans, is another major market driver. For instance, in February 2025, a new strain of H5N1 avian flu was detected in six dairy herds in Nevada, according to the U.S. Department of Agriculture. This has heightened the need for H5N1-specific vaccines and emphasized the urgency of developing rapid and effective immunization programs. The situation underscores the importance of enhanced biosecurity protocols and comprehensive vaccination strategies to protect animal and public health.

Key Market Trends & Insights

- North America dominated the market, accounting for a revenue share of over 28% in 2024.

- The U.S. animal vaccines market is witnessing significant growth.

- By product, the attenuated live vaccines segment dominated with a revenue share of over 37.0% in 2024.

- By animal type, the livestock segment held the highest revenue share in 2024.

- By distribution channel, the hospital/clinic pharmacy segment led the market in 2024.

Download a free sample PDF of the Animal Vaccines Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 13.48 Billion

- 2030 Projected Market Size: USD 22.95 Billion

- CAGR (2025–2030): 9.5%

- North America: Largest market in 2024

Competitive Landscape

The market is highly competitive, comprising both large multinational players and regional manufacturers. Key competitive factors include the rapid adoption of preventive veterinary injections and government-supported vaccine procurement programs. To maintain market share and expand product portfolios, major companies are engaging in mergers, acquisitions, partnerships, and new product launches.

For example, in February 2021, Ceva partnered with the French National Research Institute for Agriculture, Food, and Environment (INRAE) to strengthen R&D in preventing infectious animal diseases and improving overall animal health.

Recent Developments

- February 2025: Zoetis received conditional approval from the USDA CVB for its H5N2 Avian Influenza killed virus vaccines.

- February 2025: Medgene and Elanco collaborated to commercialize Elanco’s HPAI vaccine platform for dairy cattle in the U.S.

- August 2022: Zoetis expanded its poultry portfolio by launching the Poulvac Procerta HVT-IBD vaccine for protection against Infectious Bursal Disease (IBD).

- January 2022: Boehringer Ingelheim partnered with MabGenesis to develop novel canine monoclonal antibodies.

- November 2021: Ceva invested in a new cryogenic storage facility in Monor, expanding its European vaccine production capacity.

Key Companies Profiled

- Zoetis

- Merck & Co., Inc.

- Boehringer Ingelheim Animal Health

- Elanco

- Virbac

- Phibro Animal Health Corporation

- Calier

- Ceva

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global animal vaccines market is poised for robust growth, supported by rising livestock populations, expanding disease prevention programs, and growing awareness of zoonotic threats. Ongoing R&D initiatives and government-backed vaccination campaigns are strengthening market foundations. Increasing technological innovations in vaccine formulation are enhancing effectiveness and accessibility. As demand for animal-based products continues to surge, the market is expected to maintain steady momentum through the forecast period.