Aircraft Engine Market 2030: Innovations in Engine Efficiency

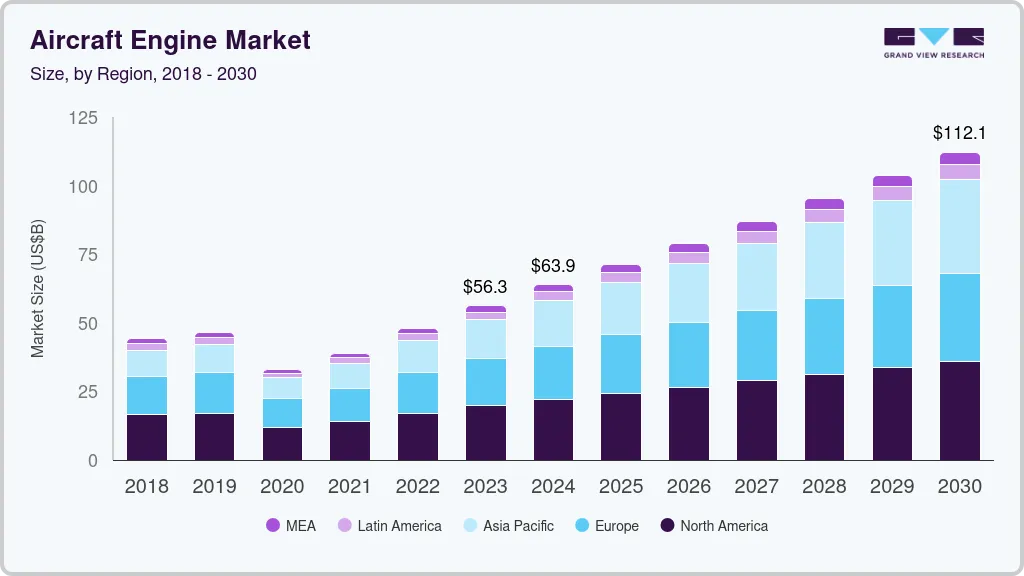

The global aircraft engine market was valued at USD 56.28 billion in 2023 and is projected to reach USD 112.10 billion by 2030.

The global aircraft engine market was valued at USD 56.28 billion in 2023 and is projected to reach USD 112.10 billion by 2030, expanding at a CAGR of 9.81% from 2024 to 2030. The market is witnessing strong growth due to increasing demand for fuel-efficient and environmentally sustainable engines.

As airlines work to lower operational costs and comply with stricter emission standards, there is a growing emphasis on engines that deliver better fuel efficiency and produce lower carbon emissions per flight. Advances in engine design, including efficient turbine technologies and the use of lightweight materials, are accelerating innovation across the industry. Furthermore, the global rise in air travel demand—both commercial and military—is fueling the need for more reliable and powerful engines to support expanding aircraft fleets.

Leading engine manufacturers are focusing on next-generation propulsion technologies such as high-bypass ratio turbofans and geared turbofans. These designs offer improvements in fuel efficiency, noise reduction, and emission control, aligning with global environmental regulations such as those outlined by the International Civil Aviation Organization (ICAO). The growing need for sustainable aviation solutions is encouraging manufacturers to introduce engine models that not only meet regulatory requirements but also reduce lifecycle operating costs.

In parallel, advancements in materials science and digital technologies are enhancing overall engine performance and reliability. Solutions such as predictive maintenance and real-time data analytics allow operators to monitor engine health more effectively, minimizing downtime and optimizing performance. The competitive landscape is shaped by major players—including Rolls-Royce, GE Aviation, Pratt & Whitney, and Safran Aircraft Engines—who invest heavily in R&D to stay ahead. Moreover, international partnerships and strategic collaborations are becoming increasingly common, promoting technology sharing and market penetration, especially in fast-growing aviation markets.

Order a free sample PDF of the Aircraft Engine Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America dominated the aircraft engine market in 2023, accounting for 35% of global revenue. This leadership is driven by a surge in air travel, fleet modernization, and increased adoption of fuel-efficient engines. Regional growth is also supported by technological advancements in engine components and enhanced maintenance capabilities.

- By engine type, the turbofan segment led the market in 2023 with a 71% revenue share. Turbofan engines are widely used in both commercial and military aviation due to their superior fuel economy, reduced noise levels, and ability to operate efficiently under various flight conditions.

- In terms of aircraft type, the commercial aircraft segment generated the highest revenue in 2023. Growing global passenger traffic is prompting airlines to invest in newer aircraft with advanced engine technologies aimed at improving fuel efficiency and minimizing environmental impact.

- By point of sale, the aftermarket segment held the largest revenue share in 2023. The dominance of this segment is attributed to increasing global air traffic and the aging fleet of aircraft, leading airlines and maintenance providers to invest more in engine repair, overhaul, and replacement services to ensure optimal uptime and cost-efficiency.

Market Size & Forecast

- 2023 Market Size: USD 56.28 Billion

- 2030 Projected Market Size: USD 112.10 Billion

- CAGR (2024-2030): 9.81%

- North America: Largest market in 2023

Key Companies & Market Share Insights

Prominent players in the aircraft engine market include Rolls-Royce, General Electric (GE), and Pratt & Whitney, all of which maintain strong global footprints and advanced R&D capabilities:

- Rolls-Royce continues to expand its influence through the development of high-performance engines like the Trent series, known for their efficiency, reliability, and support for long-haul aircraft. The company’s emphasis on strategic partnerships allows for tailored solutions that address diverse customer requirements.

- Pratt & Whitney has been a pioneer in high-thrust engine technologies, including the PW4000 and PW6000 series. The company’s focus on environmental sustainability is evident in its Geared Turbofan (GTF) engine, which reduces fuel consumption and emissions while delivering high performance.

Emerging players include ITP Aero, Engine Alliance, and Advanced Atomization Technologies Inc.:

- ITP Aero has carved a niche by developing advanced engine components and contributing to programs such as the Rolls-Royce Trent and Eurojet EJ200. Their focus on collaborative innovation strengthens their position within key engine supply chains.

- Engine Alliance, a joint venture between GE and Pratt & Whitney, specializes in high-thrust, fuel-efficient engines like the GP7200, designed for large commercial aircraft. The venture benefits from the combined engineering and technological expertise of both parent companies.

Key Players

- Advanced Atomization Technologies Inc.

- Enjet Aero

- Engine Alliance

- Safran Group

- Pratt & Whitney

- Rolls-Royce

- MTU Aero Engines AG

- CFM International

- General Electric Company

- ITP Aero

- New Hampshire Ball Bearing (MinebeaMitsumi Aerospace)

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global aircraft engine market is poised for robust growth, projected to nearly double in size from USD 56.28 billion in 2023 to USD 112.10 billion by 2030, at a CAGR of 9.81%. Key drivers include the rising demand for fuel-efficient and eco-friendly engines, expansion in global air travel, and continuous technological innovation in engine design and materials.

Manufacturers are under pressure to deliver engines that balance performance, efficiency, and compliance with environmental standards. The adoption of digital technologies, predictive maintenance, and smart engine monitoring is reshaping maintenance practices and improving long-term operational reliability. With North America leading current market share and emerging economies ramping up fleet expansion, the aircraft engine industry is set for a period of transformative growth. Strategic investments, global partnerships, and a focus on sustainability will be critical for stakeholders aiming to thrive in this evolving market.