Advanced IC Substrates Market 2033: The Role of AI in Substrate Development

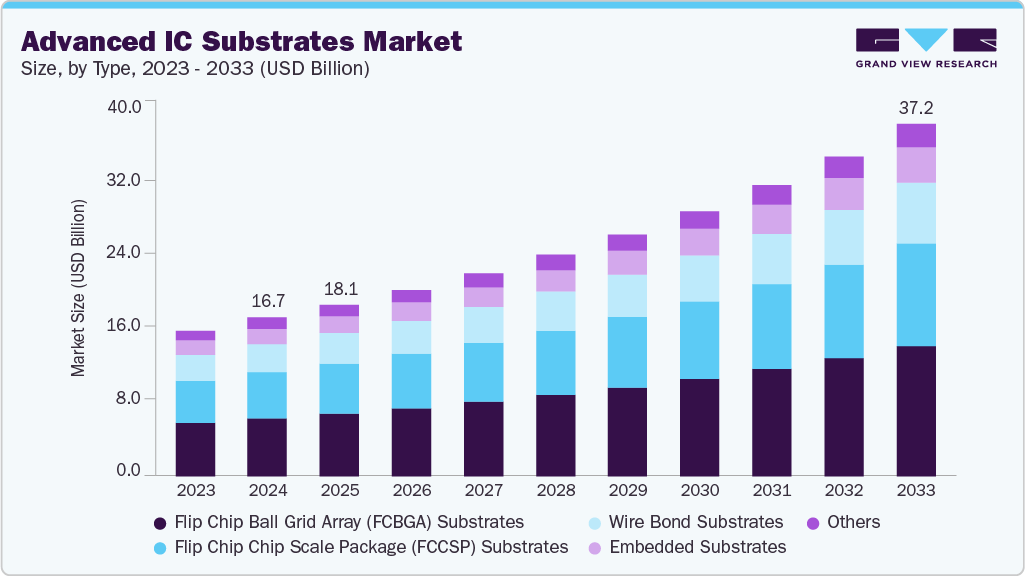

The global advanced IC substrates market was valued at USD 16.73 billion in 2024 and is projected to reach USD 37.20 billion by 2033.

The global advanced IC substrates market was valued at USD 16.73 billion in 2024 and is projected to reach USD 37.20 billion by 2033, growing at a CAGR of 9.4% from 2025 to 2033. A major driver of this growth is the increasing adoption of heterogeneous integration and chiplet-based architectures, which are creating demand for high-density substrates capable of supporting compact, energy-efficient, and high-performance semiconductor packaging. These substrates are essential across key sectors such as AI, 5G, and automotive electronics.

The global transition to electric mobility and cleaner transportation systems is significantly accelerating the demand for advanced IC substrates. In particular, wide bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN) are being increasingly used in electric vehicle (EV) powertrains and high-voltage industrial systems. Silicon carbide has gained prominence, especially in EV inverters used by companies like Tesla, due to its high thermal conductivity and electric field tolerance—key properties for high-performance automotive environments. This trend aligns with forecasts indicating that semiconductors will represent over 20% of a premium vehicle's value by 2030, compared to only 4% in 2019, further propelling the demand for advanced substrates capable of handling high voltages and temperatures.

Simultaneously, the rapid rise of artificial intelligence (AI) is reshaping semiconductor packaging needs. AI chips require faster data transfer, lower power consumption, and superior thermal management. In response, the industry is developing more advanced packaging solutions. Initiatives like the National Advanced Packaging Manufacturing Program have identified AI as a major innovation driver, prompting targeted investments in packaging equipment, power delivery systems, and chiplet support technologies. With up to USD 100 million in funding expected over the next five years, these government-backed efforts are fueling demand for high-density, thermally efficient substrates tailored for AI workloads in both data centers and edge computing environments.

Order a free sample PDF of the Advanced IC Substrates Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific led the global advanced IC substrates market in 2024, accounting for 58.9% of the total revenue. This leadership is underpinned by strong government strategies across China, Japan, and India. Notably, China’s 14th Five-Year Plan prioritizes semiconductor development, directing significant investment into R&D and fabrication of advanced substrate technologies such as FCBGA and HDI.

- By type, the flip chip ball grid array (FCBGA) substrates segment held the largest market share at 36.5% in 2024. The growth is driven by the increasing integration of AI accelerators and high-speed interfaces in data center chips, which benefit from FCBGA’s superior electrical and thermal performance.

- In terms of technology, the high-density interconnect (HDI) substrates segment led the market in 2024. Smartphone manufacturers are pushing the limits of miniaturization to embed advanced features like AI processing, triple cameras, in-display fingerprint sensors, and multi-band RF modules—all requiring HDI substrates with finer lines, stacked vias, and compact layouts.

- By application, the mobile and consumer electronics segment dominated in 2024 and is expected to grow at a strong CAGR through the forecast period. The growing use of multi-chip packaging for advanced camera functions, real-time translation, and on-device security is reshaping substrate requirements in this space.

Market Size & Forecast

- 2024 Market Size: USD 16.73 Billion

- 2033 Projected Market Size: USD 37.20 Billion

- CAGR (2025-2033): 9.4%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

The global advanced IC substrates market is supported by major industry players with large-scale production capabilities and strong technological expertise. Companies like ASE Technology Holding, AT&S Austria Technologie & Systemtechnik AG, Fujitsu, IBIDEN, and KINSUS Interconnect Technology Corp. continue to lead through innovation and strategic collaboration.

- ASE Technology Holding is one of the world’s largest semiconductor assembly and test service providers. It plays a key role in the IC substrate space with comprehensive offerings including FCBGA, SiP, and Embedded Substrate solutions tailored for computing, mobile, networking, and automotive applications. Its expertise in heterogeneous integration positions it as a leader in supporting next-gen chip architectures.

- AT&S Austria Technologie & Systemtechnik AG is globally recognized for manufacturing advanced printed circuit boards (PCBs) and IC substrates. The company’s portfolio includes flip chip, coreless, and HDI substrates designed for applications ranging from high-performance processors to medical electronics. With strong R&D capabilities and a focus on miniaturization and signal integrity, AT&S remains a preferred supplier in high-frequency, high-density packaging markets.

These companies maintain competitive advantages through robust global footprints, investment in R&D, and alignment with sustainability and innovation trends. Their continued development of coreless, embedded, and high-density substrates ensures their importance within the rapidly evolving semiconductor packaging ecosystem.

Key Players

- ASE TECHNOLOGY HOLDING

- AT&S Austria Technologie & Systemtechnik Aktiengesellschaft

- Fujitsu

- IBIDEN

- KINSUS INTERCONNECT TECHNOLOGY CORP

- KYOCERA Corporation

- LG Innotek

- NAN YA PLASTICS CORPORATION

- SAMSUNG ELECTRO-MECHANICS

- Unimicron

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global advanced IC substrates market is poised for substantial growth, expanding from USD 16.73 billion in 2024 to USD 37.20 billion by 2033 at a CAGR of 9.4%. The market's expansion is fueled by major technological shifts, including the adoption of chiplet-based architectures, the proliferation of AI applications, and the transformation of the automotive sector toward electric vehicles.

With increasing requirements for high-performance, thermally efficient, and miniaturized substrates, advanced IC substrates are becoming essential components in next-generation semiconductor packaging. Asia Pacific leads the market, supported by aggressive government investments and a robust manufacturing ecosystem. Meanwhile, leading players like ASE and AT&S are innovating rapidly to meet the complex demands of applications in AI, 5G, EVs, and consumer electronics.